How To File Llc Taxes In New York

Have the state license for each professional who will be a member of the company file articles of organization with the Division of Corporations DOC within the New York Department of State DOS. The drawbacks to filing your business as self-employment income aka.

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Time

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Time

Cost of Doing Business 200 filing fee 9 biennial statement.

How to file llc taxes in new york. An LLC is a kind of legal protection granted to companies willing to file that way on the state level. An LLC or LLP that is treated as a partnership may be required to file a Form IT-204 Partnership Return. In New York corporate income tax appears in the form of a corporation franchise tax when applied to New York C-corporations and New York S-corporations.

Amount of annual filing fee. For New York limited liability companies limited liability partnerships and general partnerships corporate income tax is referred to simply as a filing fee. Learn how small businesses are taxed in New York and understand how tax rates vary based on whether the business is an S corporation LLC or partnership.

Instead tax for a New York LLC works as follows. Your choice will directly influence the tax filing rules you are subject to. By filing annual.

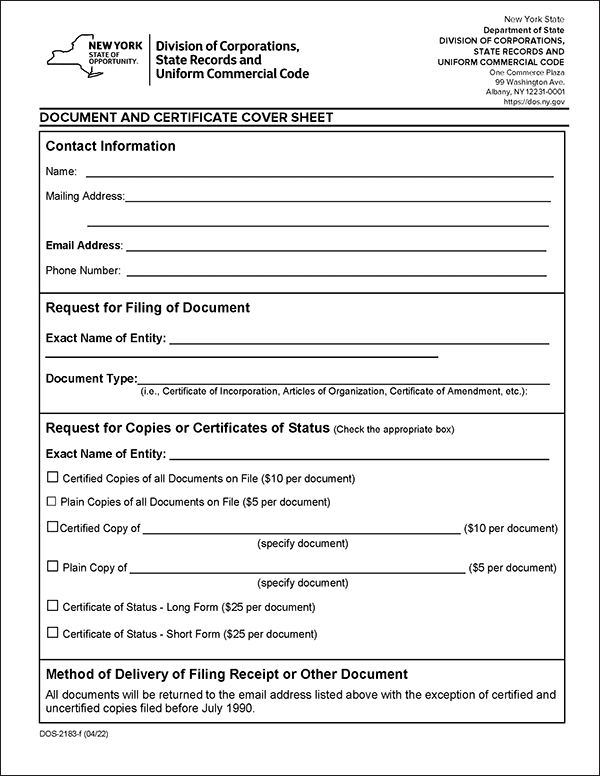

In person deliver the Articles of Organization to the above address. The IRS allows the LLC to use partnership corporate or sole proprietor tax rules. In Texas the business tax is called the franchise tax.

NYC is a trademark and service mark of the City of New York. The publications are chosen by the County Clerks office and the cost of publication can be anywhere from 200 to over 1500. The profits of a New York LLC are not taxed at the business level like those of C Corporations.

Fillable Foreign Professional Service Application for Authority Form. Northwest 39 state fee or LegalZoom 149 state fee Check out Northwest vs LegalZoom Depending on your type of business you will likely need to register with the New York State Department of Taxation and Finance. If an LLC or LLP did not have any New York Source gross income for the.

Business Income and Excise Taxes 2019 Business Tax Return Filing Information and the COVID-19 Outbreak. An LLC or LLP that has elected to be treated as a corporation for federal income tax purposes. New York LLC owners pay self-employment tax on business profits.

New York LLC owners pay state tax on any profits less state allowances or. To form your New York PLLC youll need to. New York is one of only a few states that requires newly formed LLCs to publish a notice of formation in two newspapers for six consecutive weeks.

There is no set of tax rules that specifically apply to LLCs. By mail send the completed Articles of Organization with the filing fee of 200 to the New York State Department of State Division of Corporations State Records and Uniform Commercial Code One Commerce Plaza 99 Washington Avenue Albany New York 12231. Businesses that are obligated to pay it are capped at 1 of income which is much lower than the state income tax in many places.

If you operate your business using a limited liability company LLC then you have more flexibility in choosing how the IRS taxes your business earnings. Business Tax Filing Information and the COVID-19 Outbreak Effect of IRS Deadline Extension for 2020 NYC Individual UBT Filers. An LLC or LLP that is treated as a corporation for federal income tax purposes may be required to file a New York State.

Sole proprietorship single member LLC or disregarded entity include the following. The amount of the filing fee will be based on the New York source gross income for the tax year immediately preceding the tax year for which the fee is due preceding tax year. An LLC that is treated as a sole proprietorship must report its business income and expenses on the individuals New York State personal income tax returns.

You need to file your LLC taxes when your business brings in money either through revenue or a loan or when it is eligible for a deduction or tax credit. The completed application together with the filing fee of 200 should be forwarded to the New York Department of State Division of Corporations One Commerce Plaza 99 Washington Avenue Albany NY 12231. Hire a professional to form your LLC in New York.

You are the only partner and bringing in other partners in for tax purposes will be difficult to achieve on a 1040 return.

New Tax Law Take Home Pay Calculator For 75 000 Salary

First Day Of Filing Taxes Is January 20 Please Call Our Office 7183320000 Great Customer Care And Reasonable Prices Tax Accountant Filing Taxes Tax

First Day Of Filing Taxes Is January 20 Please Call Our Office 7183320000 Great Customer Care And Reasonable Prices Tax Accountant Filing Taxes Tax

Tax Accountants Irs Enrolled Agents Tax Accountant Enrolled Agent Income Tax Return

Tax Accountants Irs Enrolled Agents Tax Accountant Enrolled Agent Income Tax Return

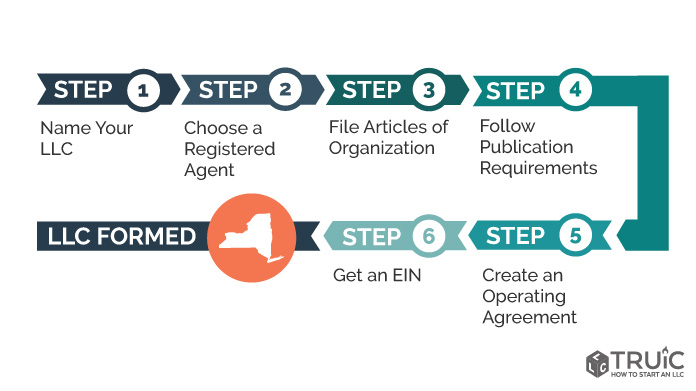

![]() Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

The Irs Allows You To Correct Mistakes On A Tax Return You Ve Already Filed By Filing An Amended Tax Return If You Make A Mistak Tax Accountant Tax Tax Return

The Irs Allows You To Correct Mistakes On A Tax Return You Ve Already Filed By Filing An Amended Tax Return If You Make A Mistak Tax Accountant Tax Tax Return

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day

Limited Liability Companies Frequently Asked Questions Nys Dos

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

Choosing The Right One For Your Company Depends On Your Particular Business Operational Needs And Tax Strategy Tax Accountant Tax Accounting

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Dont Waste Your Tax Refund On Matching Tennis Shoes And Outfits This Year Call Me Lets Get You In A House Alwaysworking Filing Taxes Tax Refund Income Tax

Dont Waste Your Tax Refund On Matching Tennis Shoes And Outfits This Year Call Me Lets Get You In A House Alwaysworking Filing Taxes Tax Refund Income Tax

Income Tax Form For Llc Five Facts That Nobody Told You About Income Tax Form For Llc Tax Forms Income Tax Told You So

Income Tax Form For Llc Five Facts That Nobody Told You About Income Tax Form For Llc Tax Forms Income Tax Told You So

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

How Should You Register Your Company Incorporated Vs Limited Liability Company Business Finance Llc Business Accounting Classes

Llc New York How To Form An Llc In New York

Llc New York How To Form An Llc In New York

Lower Your Property Taxes Now Here S How To File A Winning Appeal Estate Tax Homeowner Taxes Property Tax

Lower Your Property Taxes Now Here S How To File A Winning Appeal Estate Tax Homeowner Taxes Property Tax

Tax Returns Day Ii Bulltaxaccountants Tax Accountant Tax How To Plan

Tax Returns Day Ii Bulltaxaccountants Tax Accountant Tax How To Plan

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes