How To File Additional 1099 Misc After Deadline

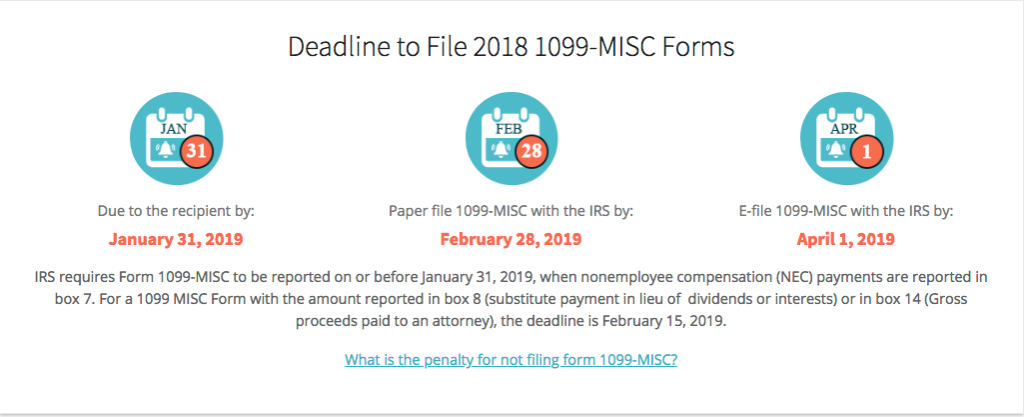

1099 Due Date to Recipients. Heres how to file an amended tax return.

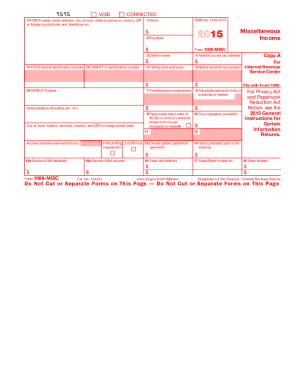

Irs 1099 Misc Form Deadline Irs Forms Irs Internal Revenue Service

Irs 1099 Misc Form Deadline Irs Forms Irs Internal Revenue Service

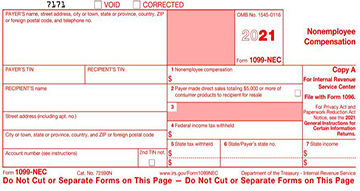

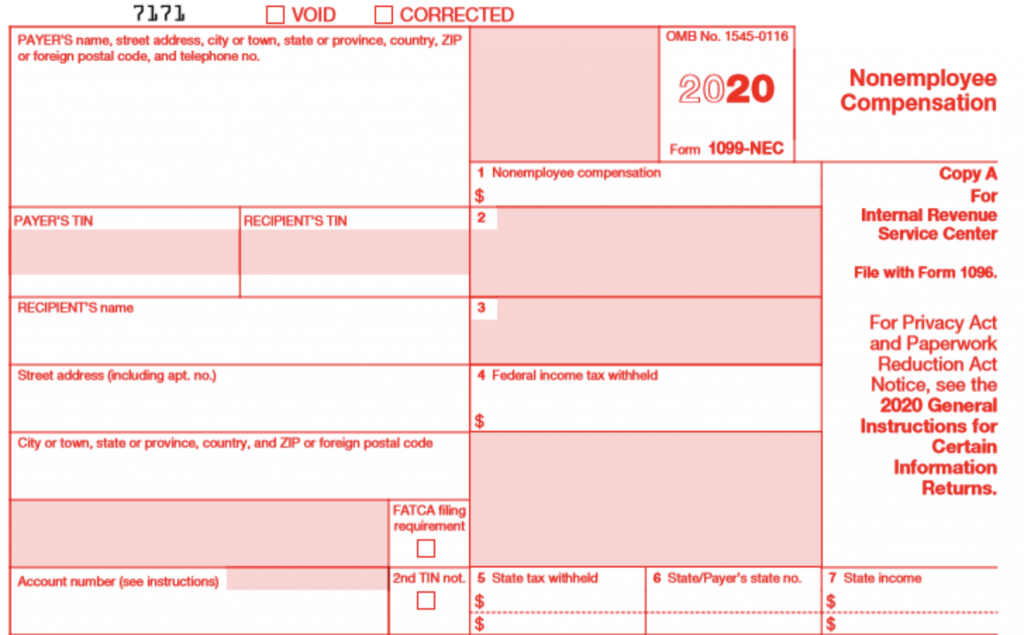

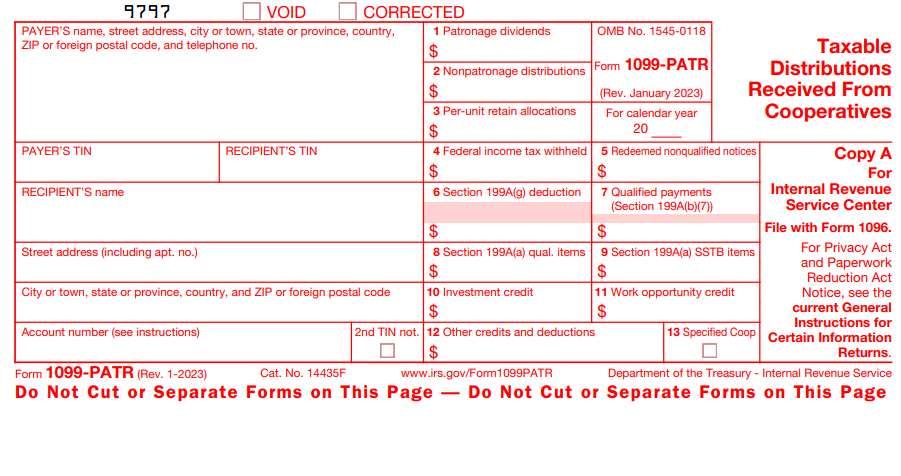

The IRS reintroduce a form 1099-NEC for non-employee compensation to avoid the confusion of deadlines.

How to file additional 1099 misc after deadline. Send Copy B of 1099-Misc to the recipient by February 1st 2021. 1099-MISC With Data in Boxes 8 or 10 February 16 2021. File Form 1099-NEC providing inaccurate information failing to provide all the required information and filing after the deadline.

If you cannot file your 1099 forms by the due date it is possible to get an extension to file 1099 forms. Filing an Additional 1099 Complete the respective Form 1099 for the additional payee in the same manner as the previous Form 1099s. In case if you were unable to file 1099 on time you always have the option to request a 30-day extension by filing IRS Form 8809 Extension of Time to File Information Returns.

Form 1099 Misc has two deadlines for different payments. Submit any missed forms or corrected information immediately. 31 days late August 1 110 per statement.

You can file a Form 8809 to request a 30-day extension for 1099-MISC and other forms except 1099-NEC. Form 1099 NEC Useful to Avoid the Confusion Of Deadlines. What are the filing deadlines for 1099-MISC and 1099-NEC.

If payer file 1099-Misc form. Mail the corrected Form 1099-NEC and 1096 to the IRS and any required state tax departments. For succeeding filings the excise tax starts on July month 1st and ends on June month 30th.

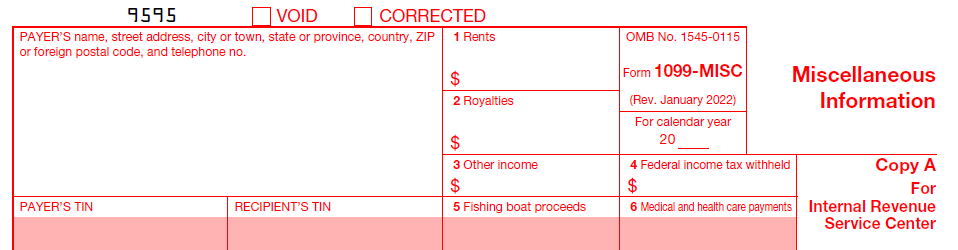

Remember that its unnecessary to complete a. Beginning with the 2020 tax year the Form 1099-MISC deadline is March 1 if you file on paper and March 31 if you file electronically. It also lets you avoid having to file the related Form 1096 with the 1099 IRS copies by February 28th.

The 1099-Misc Form 2020 filing deadlines are based on the type of filing. Small Business Gross receipts of 5 million or less Maximum penalty of 194500. The corrected box should only be checked if information initially filed on a form is incorrect.

Record the correct information and other information like you did in the original return. Heres What The May 17 Deadline Means For Your Taxes. Prepare a new Form 1096 as well with corrected information.

201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February. Filing to IRS By Mail. File your 1099-Misc Form to the IRS by March 1 2021 through paper forms.

Businesses must send Form 1099-MISC to recipients by February 1 2021 and file it with the IRS by March 1 March 31 if filing electronically. Forms 1099-MISC and 1099-NEC and their instructions such as legislation enacted after they were published go to IRSgovForm1099MISC or IRSgovForm1099NEC. Large Business Gross receipts of 5 million or more Maximum penalty of 556500.

Mail or hand in the corrected Form 1099-NEC to your independent contractor. 1099-MISC No Data in Boxes 8 or 10 February 1 2021. There are two types of extensions possible for 1099-NEC - extension for filing 1099 forms with the IRS extension for providing recipient copies of 1099-NEC.

The deadline for filing Form 1099-NEC with the IRS and sending recipient copies for the 2020 tax year is Feb 01 2021. You MUST have a valid reason for getting an extension from the IRS. Start For Free and Make it Easy.

Not more than 30 days late 50 per statement. If file electronically then the filer must file his form by March 31 2021. Please find out Is it possible to get an extension to file 1099-NEC.

Those forms are due to recipients. You can go to the IRS website at any time and download any necessary forms fill them out and send them in for processing. The PATH Act PL.

The good news is that if you do need to file an additional 1099 after filing the 1096 form its easy to access the needed forms. You just file them once on-line and youre done. Companies operating heavy vehicles must file form 2290.

When filing a Form 1099 for an additional payee you should not check the corrected box of Form 1099. When Do I File a 1099-Misc Form with the IRS. Why Did I Receive Form 1099-NEC Instead Of Form 1099-MISC This Year.

1099 Non-Employee Compensation Reporting at an affordable price. You can then work on submitting information to the IRS in an attempt to prove that this was not due to your negligence. IRS Form 1099 Misc Online Filing should finish by February 1st 2021.

Whats New Form 1099-NEC. Penalties for late 1099 filings range from 30 - 100form. The cost of filing 1099s on-line ranges from about 56 to 350 per form depending on your volume and whether or not you need the service provider to send out paper forms to some of your vendors.

If you have missed the deadline for filing 1099s the best thing you can do is take action right away. Penalties for intentionally disregarding the requirement are 250form. If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676.

If businesses are using Forms 1099-MISC to report amounts in box 8 Substitute Payments in Lieu of Dividends or Interest or box 10 Gross Proceeds Paid to An Attorney there is an exception to the normal due date. Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. These tax returns and extension due dates are possible by opting for the e-filing option.

I Missed The Form 1099 Misc Deadline What Happens Next Blog Taxbandits

I Missed The Form 1099 Misc Deadline What Happens Next Blog Taxbandits

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

E File Form 1099 Nec Online How To File 1099 Nec For 2020

E File Form 1099 Nec Online How To File 1099 Nec For 2020

What S The New 1099 Nec For Non Employee Compensation

What S The New 1099 Nec For Non Employee Compensation

Form 1099 Nec Vs 1099 Misc For Tax Year 2020 Blog Taxbandits

Form 1099 Nec Vs 1099 Misc For Tax Year 2020 Blog Taxbandits

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Software 289 Efile 449 Outsource 1099 Misc Software

1099 Misc Software 289 Efile 449 Outsource 1099 Misc Software

2015 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

2015 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

3 Form Or W3 How You Can Attend 3 Form Or W3 With Minimal Budget Tax Forms Form Example Addition Words

3 Form Or W3 How You Can Attend 3 Form Or W3 With Minimal Budget Tax Forms Form Example Addition Words

Quickbooks Integration Taxbandits

Quickbooks Integration Taxbandits

Form 1099 Penalties Late Filing Penalties For 1099 Forms

Form 1099 Penalties Late Filing Penalties For 1099 Forms

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

State And Federal Deadlines And Important Reminders For Filing 1099 Forms