How To Make A Dormant Company Active

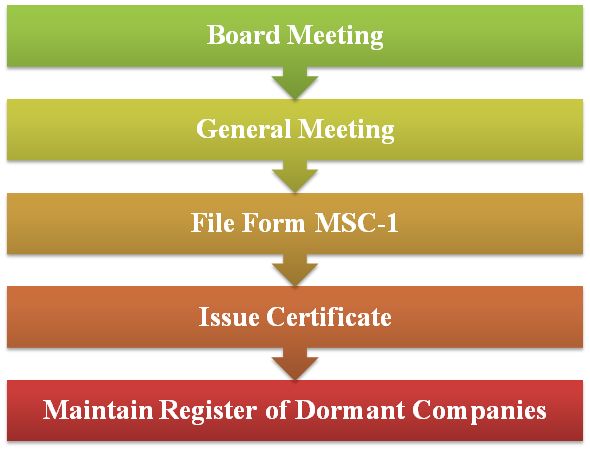

PROCEDURE TO GET THE COMPANYS STATUS AS DORMANT Step 1. Its important to note that the wellbeing of the dormant company is threatened and its mere existence is put into jeopardy by the failure to supply these documents.

Conversion Of Dormant Company Into Active Company Corpbiz

Conversion Of Dormant Company Into Active Company Corpbiz

If youve traded in the past you can re-register as active for Corporation Tax via your HMRC online account.

How to make a dormant company active. How to make your dormant company active again When your business is ready to start trading again you should undertake the following four steps. First you must call for a board meeting to fix the time and venue to call an extraordinary general meeting of the members to pass a special resolution at least 34th in value. Pay fines penalties or fees to ACRA.

Reregister for Corporation Tax with the HMRC Send your accounts to Companies House within nine months of your companies end year. A dormant company will need to file its Income Tax Return using the File Form C-S C for Dormant Company e-Service at mytaxirasgovsg. If your company become active for example by starting to trade you must notify HMRC within three months.

To get back the status as active company is required to file form MSC-4 with ROC accompanied by a return in Form MSC-3. The director can make a general application for dormant status with ROC in this board meeting. Make sure the company bank account is non-interest bearing if you receive any interest you wont be dormant anymore.

Gather all information required to complete the form including your document number. The status of your company will be changed from dormant to active and then will be fit for filing a Company Tax Return or paying corporation tax. Where the freehold is owned by a limited company and has its own income in the form of ground rents which is investment income for the freeholder bank and building society interest or it has received a lump sum for a lease extension then that company is considered to be active.

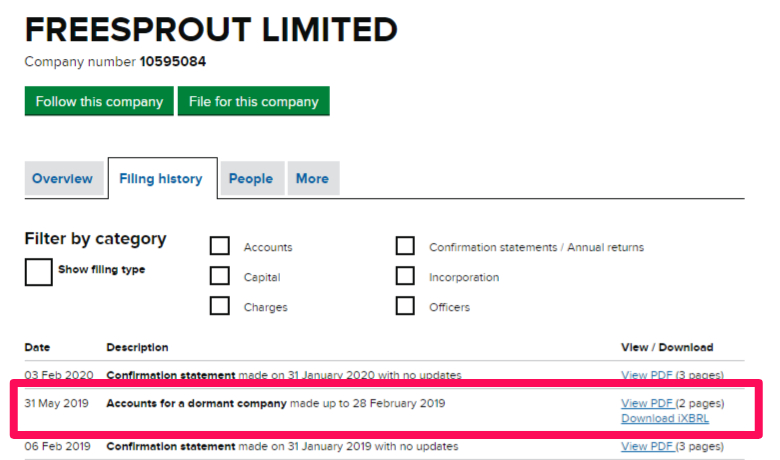

All these items are taxable and require the filing of more detailed accounts than those required by a dormant company. What it means to be dormant for Corporation Tax or Companies House - trading and non-trading annual accounts Company Tax Returns and telling HM Revenue and Customs HMRC. If company is carrying any Significant transaction during the dormant period the directors need to file an application with ROC in e-form MSC-4 within seven days from such event for obtaining the status of an active company.

In order to make an existing active company dormant all bills must be paid and contracts cancelled. Maintain a registered office registers and books. It considers a company Dormant if it had no accounting transactions within a given period.

Any corporation limited liability company limited partnership or limited liability limited partnership whose status was administratively dissolved or revoked can submit an electronic reinstatement application. In this article we will be discussing how a. Pay all of your bills.

ACRA still treats your company as Dormant even if it does the following. There seem to be several reasons why dormant accounts are not filed on time. Most dormant companies will become active again at some point in their lives.

Any agreements with customers should be terminated and amounts due or owing reconciled. If dormant company wants to carry on any business activities then it need to apply to the registrar of companies to change the status to active. The prudent dormant company will make a note of the date so that it does not miss the deadline.

Review the instructions for filing a reinstatement. You start business activities again on 1 May. To e-File you must first be authorised as an Approver in CorpPass.

How do I make my company dormant. You can inform HMRC about your companys active status. If company started carrying any significant transaction having status as dormant then within 7 days from the date of transaction company need to file an application with ROC in form MSC-4 accompanied by a return in Form MSC-3 to get back the status active from the earlier status of.

Terminate contracts with your service providers. There is no need to submit financial statements to IRAS. How to make your dormant company active If you decide to become an active company you must contact HMRC within three months of any kind of business activity or income.

When your inactive company becomes active you will have to notify HMRC within three months of starting any business activity. Appoint a company secretary. The easiest way is to use HMRCs online registration service to.

Your non-trading or dormant companys accounting reference date is 30 September. You make a set of statutory accounts for the usual period from 1. ROC if satisfied forfeit the dormant status and consider it as active.

For assistance on CorpPass setup please refer to the Step-by-Step Guides. For conversion of Dormant Company to Active Company a company is required to follow the following procedure- A Dormant Company shall make an application for obtaining the status of an active company in Form MSC-4 along with the fees as provided in the Companies Registration Offices and Fees Rules 2014.

How To Submit A Zimra Paye Nil Return Companies House Prevention Activities

How To Submit A Zimra Paye Nil Return Companies House Prevention Activities

Dormant Companies Explained The Accountancy Partnership

Dormant Companies Explained The Accountancy Partnership

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two Options Tax Return Singapore Tax

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two Options Tax Return Singapore Tax

Conversion Of Dormant Company Into Active Company Corpbiz

Conversion Of Dormant Company Into Active Company Corpbiz

Dormant Company Registration Thecompanywarehouse Co Uk

Dormant Company Registration Thecompanywarehouse Co Uk

Dormant Company Section 455 Of Companies Act 2013

Dormant Company Section 455 Of Companies Act 2013

How To Complete Form Aa02 Dormant Company Accounts 1

Draft Board Resolution For Obtaining Status Of Dormant Company

Draft Board Resolution For Obtaining Status Of Dormant Company

Looking For Professional Accountants In Worthing Accounting Business Bank Account Opening A Business

Looking For Professional Accountants In Worthing Accounting Business Bank Account Opening A Business

Dormant Company Accounts Saving You Time And Money

Dormant Company Accounts Saving You Time And Money

How To File Dormant Accounts Online Youtube

How To File Dormant Accounts Online Youtube

Change In Status Of Company From Active To Dormant Cash Flow Statement Public Limited Company Financial Position

Change In Status Of Company From Active To Dormant Cash Flow Statement Public Limited Company Financial Position

How To File A Dormant Company Tax Return Youtube

How To File A Dormant Company Tax Return Youtube

The Difference Between Dormant And Non Trading Companies The Accountancy Partnership

How To Make A Company Dormant A Guide For Small Businesses

How To Make A Company Dormant A Guide For Small Businesses

Hong Kong Dormant Company What You Should Know

Hong Kong Dormant Company What You Should Know

How To File Your Dormant Accounts Youtube

How To File Your Dormant Accounts Youtube

The Companies House Status Says My Company Is Active What Does This Mean Company Formation Madesimple

The Companies House Status Says My Company Is Active What Does This Mean Company Formation Madesimple

Filing Accounts For Your Dormant Company Companies House

Filing Accounts For Your Dormant Company Companies House