What Is Form 3800 General Business Credit

Credits are aggregated according to several criteria. Carryforwards to that year the earliest ones first.

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Youll figure each sub-investment credit separately.

What is form 3800 general business credit. If your first year for claiming the low-income housing credit was in 1998 then 2017 will be the last year to claim this credit. 38 limitation is calculated on Form 3800 General Business Credit. The credits supported by our program that will populate on this form are.

In some cases each credit must be claimed on its own unique form the source form. In addition all the credits must have been incurred from passive activity form 8582-CR. Each credit is generally computed on a tax form for that particular credit.

Department of the Treasury Internal Revenue Service 99 General Business Credit. The IRSs website currently lists 25 eligible business credits although this can change from year to year. The general business credit earned in that year.

Keep track of each separate credit you claim because they are considered used up in a certain order. Therefore the order in which the credits are used in any tax year is. What is the General Business Credit Form 3800.

Feb 03 2021 The General Business Credit Form 3800 is used to accumulate all of the business tax credits you are applying for in a specific tax year to come up with a total tax credit amount for your business tax return. General business credits reported on Form 3800 are treated as used on a first-in first-out basis by offsetting the earliest-earned credits first. The General Business Credit Form 3800 calculates the total amount of tax credits youre eligible to claim in a particular tax year.

A Credit for increasing research activities is reported on Form 3800 Line 4i if the credit is from an eligible small business. The individual credits are tallied up separately on their individual forms each calculated under its own set of rules. The resulting combined credit is.

General business credits reported on Form 3800 are treated as used on a first-in first-out basis by offsetting the earliest-earned credits first. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. The one credit is considered your general business credit.

It is the taxpayers net income tax. General Business Credit - Form 3800 While the name is singular the general business credit form consists of numerous credits that may be taken by an individual who qualifies for the credit. I nvestment Form 3468.

Passive or nonpassive current year credits. If the business that generated the credit is not an eligible small business the research credit will be reported on Form 3800 Line 1c. You will be able to deduct the remaining credit amount next year.

Investment credit Form 3468 Low-income housing credit Form 8586 Disabled access credit Form 8826 The investment credit is also made up of several different credits. Mar 08 2021 Information about Form 3800 General Business Credit including recent updates related forms and instructions on how to file. A taxpayer must file Form 3800 to claim any of the general business credits.

If you claim only one credit. Form 3800 is not required. Form 3800 is a Federal Corporate Income Tax form.

Instead the taxpayer may be able to report the credit directly on Form 3800. Things to Keep in Mind About the General Business Credit. Sep 12 2019 What is Form 3800.

If you claim multiple business credits then our program will draft Form 3800 General Business Credits onto your return. You need to file form 3800 for general business credit if you have more than one credit to report and you have carry forward or carry back from previous years. If the taxpayers only source of credits listed on Form 3800 is from pass-through entities the taxpayer may not be required to complete the source credit form.

Jun 14 2017 The general business credit Form 3800 is made up of many other credits like. And The carryback to that year. See the instruction on Form 3800.

You must attach all pages of Form 3800 pages 1 2 and 3 to your tax return. The sum of regular tax and alternative minimum tax less any other allowable credits over the greater of 1 tentative minimum tax or 2 25 of the taxpayers regular tax in. For instructions and the latest information.

If your general business credits exceed. Some common tax credits apply to many taxpayers while others only apply to. Therefore the order in which the credits are used in any tax year is.

Jun 04 2019 This General Business Credits Carryforward section of TurboTax goes back to 1998 when selecting the first year the credit was claimed. Form 3800 is used by filers to claim any of the general business credits.

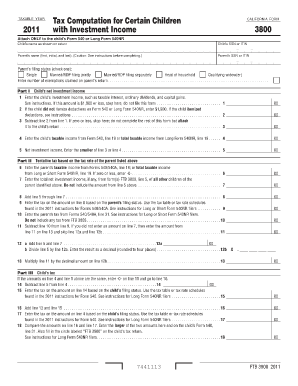

California Form 3800 Fill Online Printable Fillable Blank Pdffiller

California Form 3800 Fill Online Printable Fillable Blank Pdffiller

Https Www Irs Gov Pub Irs Prior F3800 2005 Pdf

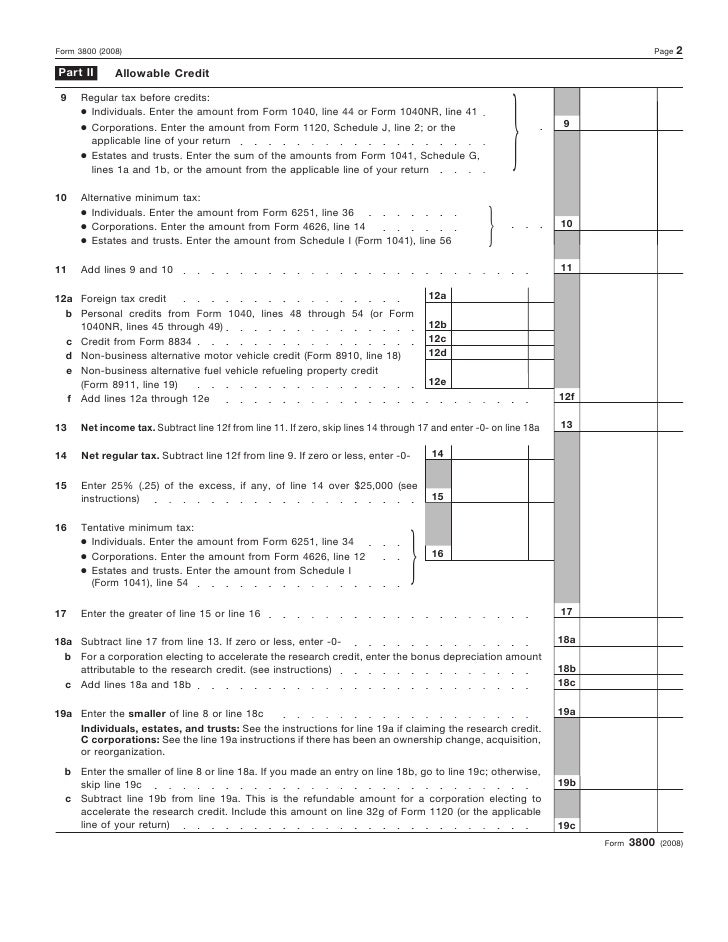

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 General Business Credit

Form 3800 General Business Credit

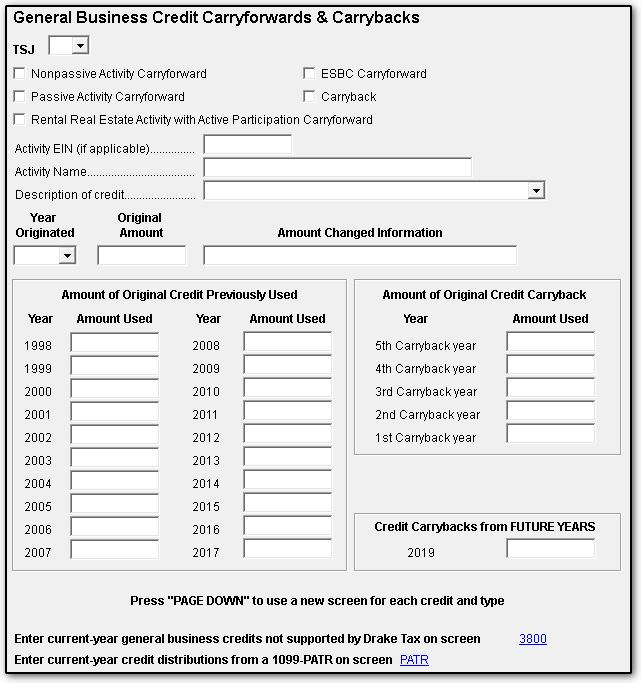

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 How To Complete It Fora Financial Blog

Form 3800 How To Complete It Fora Financial Blog

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Instructions For Form 8582 Cr 12 2019 Internal Revenue Service

Instructions For Form 8582 Cr 12 2019 Internal Revenue Service

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Form 3800 Instructions Filing General Business Credit Form

Form 3800 Instructions Filing General Business Credit Form

Gbc And 3800 Screens For General Business Credits

Gbc And 3800 Screens For General Business Credits

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit 2014 Free Download

Form 3800 General Business Credit

Form 3800 General Business Credit

Form 3800 Fill Online Printable Fillable Blank Pdffiller

Form 3800 Fill Online Printable Fillable Blank Pdffiller