What Companies Are 1099 Reportable

The Substitute Form W-9 is available on the. A 1099 vendor is someone who does work for your business.

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc

If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll.

What companies are 1099 reportable. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. 1099-S one of those types and its used for reporting capital gains on real estate transactions. The 1099-B for brokerage transactions.

NOT REPORTABLE IN 1099PRO Do not report the check data if any of the below apply. You may be surprised at the extent of companies and individuals that qualify for 1099 MISC which is. Earnings reported by brokerages on a 1099-DIV or 1099.

The 1099-A when you acquire interest in property as security for a transaction. 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. What is a 1099 vendor.

Check with your CPA to make sure youre being compliant with your states 1099 filing requirements. Is any foreign entity eg foreign individual foreign company etc. Some state require you to file 1099s to them as well.

Medical and healthcare payments 1099-MISC Box 6 Attorneys fees 1099-NEC Box 1 Gross proceeds to an attorney 1099-MISC Box 10. Tax law says canceled debt is income so it. Credit or travel card payments.

You M ight Need to Submit 1099 Forms With Your State. Effective tax year 2011 - local banks issue IRS. Businesses such as title companies and other persons involved in real estate transactions where no title company is involved must issue a form 199-S to anyone who receives at least 600 during the year.

The IRS generally does not require Form 1099 MISC to be issued to corporations for services but nonetheless all other business forms are required to have Form 1099 MISC reporting. Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions. For example Kickstarter and Stripe issue Creators 1099-Ks that report the gross amount paid to Creators before the Kickstarter platform fee and the Stripe processing fees.

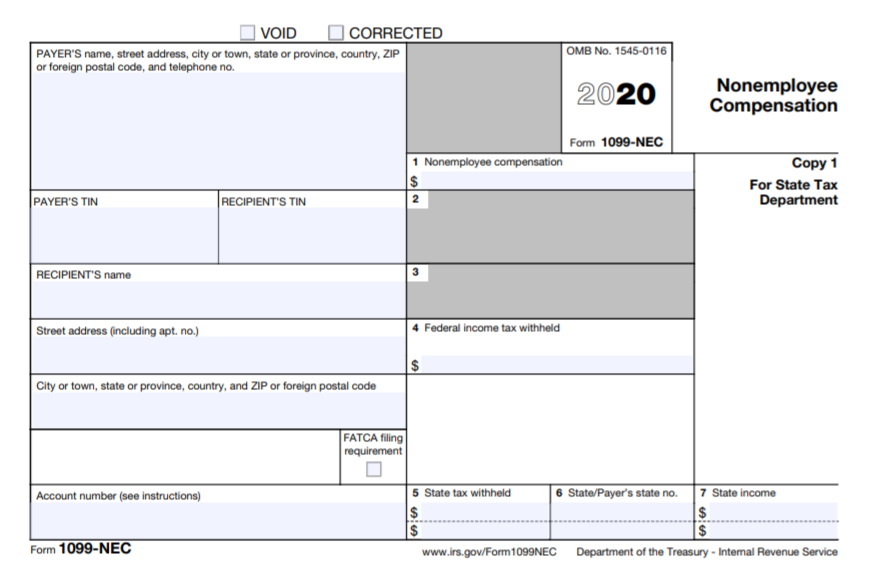

The deadline to file Form 1096 is January 31 2018. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. This form has been redesigned for 2020 to remove the reporting of non-employee income from independent contractors for example.

Where you report the information you receive via a 1099 will depend on the type of income received. If the following four conditions are met you must generally report a payment as nonemployee compensation. These include company forms such as.

You should obtain a completed Substitute Form W-9 when initiating any transaction with a new vendor that could be reportable on a 1099-MISC. Payments for which a Form 1099-MISC is not required include all of the following. However see Reportable payments to corporations later.

They think they are exempt when they are not. Examples include independent contractors and attorneys. You made the payment to someone who is not your employee.

LLCs Limited Liability Partnerships Sole Proprietors General Partnerships. According to the Internal Revenue Code any company that engages a non-corporate service provider to provide services including space for rent to which it paid at least 600 in a given tax year. Form 1099-MISC is a general-purpose IRS form for reporting payments to others during the year not including payments to employees.

So who is a 1099 vendor. There are up to 20 different types of 1099 forms. The federal government must issue 1099-MISC to corporations whereas the commercial world does not.

Real property interest is acquired from a foreign person see Pub. The IRS lists several other 1099-reportable transactions including. The IRS uses Form 1096 to track every physical 1099 you are filing for the year.

Sales or exchanges involving foreign transferors are reportable on Form 1099-S. For information on the transferees responsibility to withhold income tax when a US. On the 1099-K youre required to report the gross payments which often includes home much was sent to a payee before any processing or platform fees.

Certain payments to corporations are reportable on Forms 1099-MISC and 1099-NEC. Form 1099-MISC although they may be taxable to the recipient. The 1099-C for debt cancellation.

Business structures besides corporations general partnerships limited partnerships limited liability companies and sole proprietorships.

What Is A 1099 Misc Form W9manager

What Is A 1099 Misc Form W9manager

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Div Dividends Distributions Form1099online Efile Dividend Form

Form 1099 Div Dividends Distributions Form1099online Efile Dividend Form

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template

1099 Form Fillable Free Inspirational 1099 Misc Fillable Form 2017 At Models Form Doctors Note Template Fillable Forms Business Letter Template

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Filing Taxes Tax Tax Deductions

Filing Taxes Tax Tax Deductions