Small Business Income Tax Offset Formula

Small business income tax offset. Finally your small business not corporations may use net operating losses to offset your personal income with no limit.

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

The current tax free threshold is set at 18200 however the effect of the low income tax offsets is to increase the threshold minimum taxable income.

Small business income tax offset formula. The easiest calculation is to take the amount of the deduction for the year and multiply it by the tax rate of the person or business. You may be entitled to the small business income tax offset. As you review tax shields compare the value of tax shields from one year to the next.

Its regular taxable business income and it will be offset by those new but regular business expenses. Where your notional deductions exceed 100 million for an income year your claim for the RD tax offset is equal to the sum of notional deductions for the first 100 million multiplied by the rate determined above and the notional deductions in excess of 100 million multiplied by the company tax rate. This publication has information on business income expenses and tax credits that may help you as a small business owner file your income tax return.

Your share of net small business income cannot be a loss however it can be zero. MyTax 2020 Small business income tax offset Complete this section if you are a small business entity with a turnover less than 5 million. If your business has a higher income and a higher tax rate in one year the amount of tax savings will be higher in that year.

8582 Passive Activity Loss. The Small Business Income Tax Offset provides small businesses with a tax offset of up to 1000 per year. Individual Income Tax Return and 1040-SR US.

The Small business income tax offset can reduce the tax payable on your small business income by up to 1000 per year. Small business income tax offset calculator. If the total net small business income is greater than or equal to taxable income the offset will be 8 of the businesss basic income tax liability for the year.

Deductions claimed as a partner or beneficiary will reduce your share of net small business income. Previous Law Changes for Business Losses The 2017 Tax Cuts and Jobs Act made several significant changes to the way business losses are handled. The offset is calculated as 5 of the following amount up to the limit of 1000.

Working out your offset. This calculator works out the amount you need to enter at Net small business income on your tax return. The small business income tax offset also known as the unincorporated small business tax discount can reduce the tax you pay by up to 1000 each year.

In the years 2018-9 to 2022-23 the low income tax offsets have been adjusted several times. If the small business turnover is more than 50000 then. 6251 Alternative Minimum Tax Individuals.

The Australian Taxation Office ATO has confirmed its view that the small business tax offset can only be applied to income derived by an individual through a partnership or trust if an individual receives income directly from the partnership or trust that carries on the business and is classified as a small business entity SBE. Level Up is a gaming function not a real life function. 3115 Application for Change in Accounting Method.

Calculate the phase-out fraction with the formula 75000 small business turnover 25000. This offset is a non-refundable tax offset and will be shown as a separately in your Notice of Assessment. The maximum offset is 1000 per year per person from all your sources of small business income.

The Australian Taxation Office ATO will work out the amount of your offset based on your business income. 1099 General Instructions for Certain Information Returns. This publication provides general information about the federal tax laws that apply to you if you are a self-employed person or a statutory employee.

The small business tax offset for an income year is calculated by first determining the percentage of an individuals taxable income for the. If small business turnover is 50000 or less the offset is the result of step 1 multiplied by the result of step 2. The net small business income of a small business entity is calculated by working out the assessable income of the entity that relates to it carrying on a business and subtracting from that assessable income the entitys deductions to the extent its deductions are attributable to that income.

The offset is the step 1 amount x step 2 amount x step 41 amount. What are the eligibility criteria. 2439 Notice to Shareholder of Undistributed Long-Term Capital Gains.

Should you have any. The offset is worked out on the proportion of tax payable on your business income. Income Tax Return for Seniors.

The offset is worked out on the proportion of tax payable on your business income. This has been the effect on the tax free threshold. What this calculator does.

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Small Business Entity Aggregated Group Turnover Worksheet Sat Ps Help Tax Australia 2018 Myob Help Centre

Small Business Entity Aggregated Group Turnover Worksheet Sat Ps Help Tax Australia 2018 Myob Help Centre

Is Your Client Eligible For The Small Business Income Tax Offset

Is Your Client Eligible For The Small Business Income Tax Offset

Tax Solutions Yourlogo Start Lecture Ppt Download

Tax Solutions Yourlogo Start Lecture Ppt Download

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Should The Wealthy Pay More Income Taxes Debate Divides Maryland Democrats Wamu

Should The Wealthy Pay More Income Taxes Debate Divides Maryland Democrats Wamu

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

Small Business Tax Credits The Complete Guide

Small Business Tax Credits The Complete Guide

Tax Solutions Yourlogo Start Lecture Ppt Download

Tax Solutions Yourlogo Start Lecture Ppt Download

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

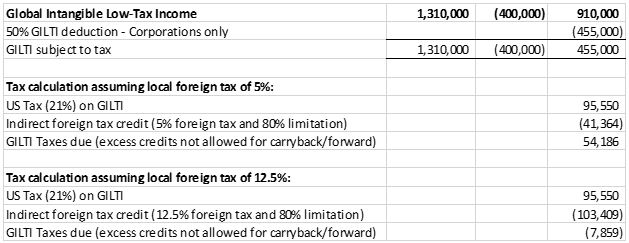

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Year End Tax Deductions For Cash Basis Small Business Owners

Year End Tax Deductions For Cash Basis Small Business Owners