Can I Change My Business Name With Hmrc

You must also update your registration details for taxes and schemes such as. Changing your name or personal address or the trading name or address of your business means you must tell HM Revenue and Customs.

Select that I would like to.

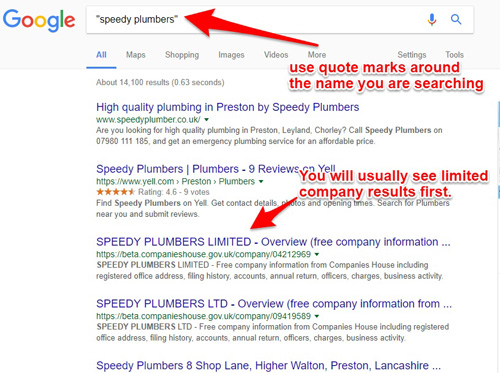

Can i change my business name with hmrc. This is known as a business name or trading name. If you follow the company names guidance and observe the restrictions a company name can be anything you choose - as long as its not the same as or too similar to another name on the register. There are a number of personal details that you must keep HMRC up to date with.

Obvious things like name address and if you change job. There are different ways of telling HMRC about changes to. The specific action required may vary depending on the type of business.

There are 2 different categories in which you can notify the HMRC of a change in your details they are separated into personal and business details so be sure to know which you require to change before following the links below. In the transaction column select CancelTransfer business name and select Go. Business owners and other authorized individuals can submit a name change for their business.

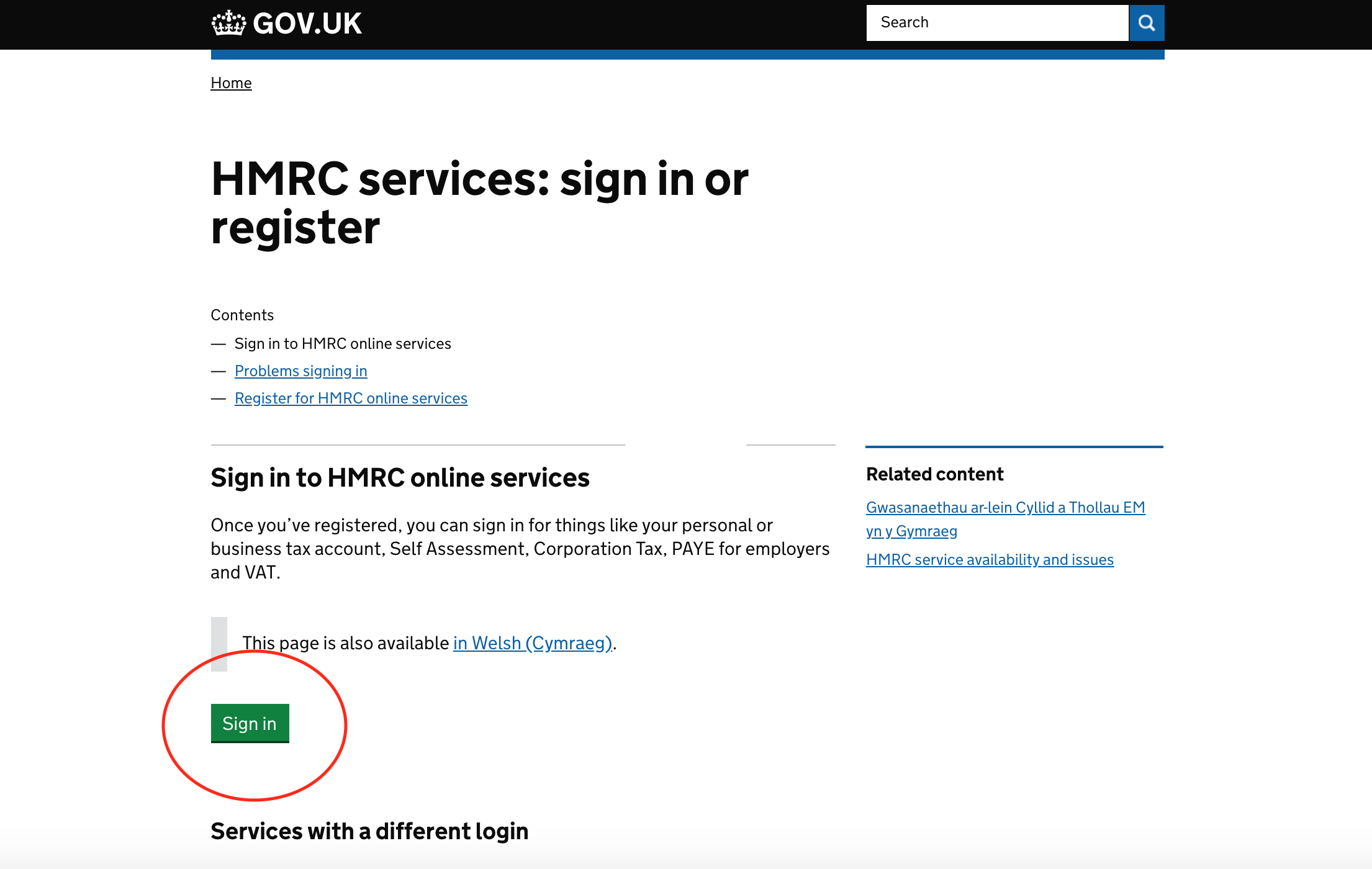

Tell HMRC about changes to your personal details and circumstances that may affect your tax code. If you dont have a Government Gateway user ID you can create one as part of the process. You should also notify all investors directors employees customers suppliers utility providers and anyone else who may be affected by the change of company name.

Even so your particular situation will determine the best method to update your name or address. Complete one form and well let everyone know youre moving home. You may have to change local business licenses and permits and you will probably need a new doing business as or business trade name notification with your county.

Youll need a Government Gateway user ID and password and your National Insurance number. The easiest way to contact HM Revenue and Customs HMRC is online. You must tell HM Revenue and Customs HMRC if you change your name business name or your personal or trading address.

If the EIN was recently assigned and filing liability has yet to be determined send Business Name Change requests to IRS Stop 6055 Kansas City MO 64999. If youre a business owner you will want to do a HMRC change of address for your business if you change your business name personal trading address name or gender. To change or update the business records.

HMRC Change Business Address or Name. When you contact the VAT Helpline by phone or webchat we will ask you to confirm the full name and address of your business and check this information against any 64-8 we hold on file. But there are more delicate matters too.

As a sole trader you can use whatever well nearly name you want as long as you still give your name in front for example John Smith ta ABC can change to John Smith ta CBA and it will not be a problem for you. As far as I know HMRC are interested only in you paying your tax. You can change your name via the HMRC website.

Complete the HMRC name change online form. The CT SA VAT etc is fine a letter to Agent Maintainer sorts out the address and practice name with HMRC for those services but not for PAYE this appears to be linked to the gateway and whatever name was used to set up the gateway is the one the PAYE side use. If this is incorrect or an email address has not been provided you can update your business name address details.

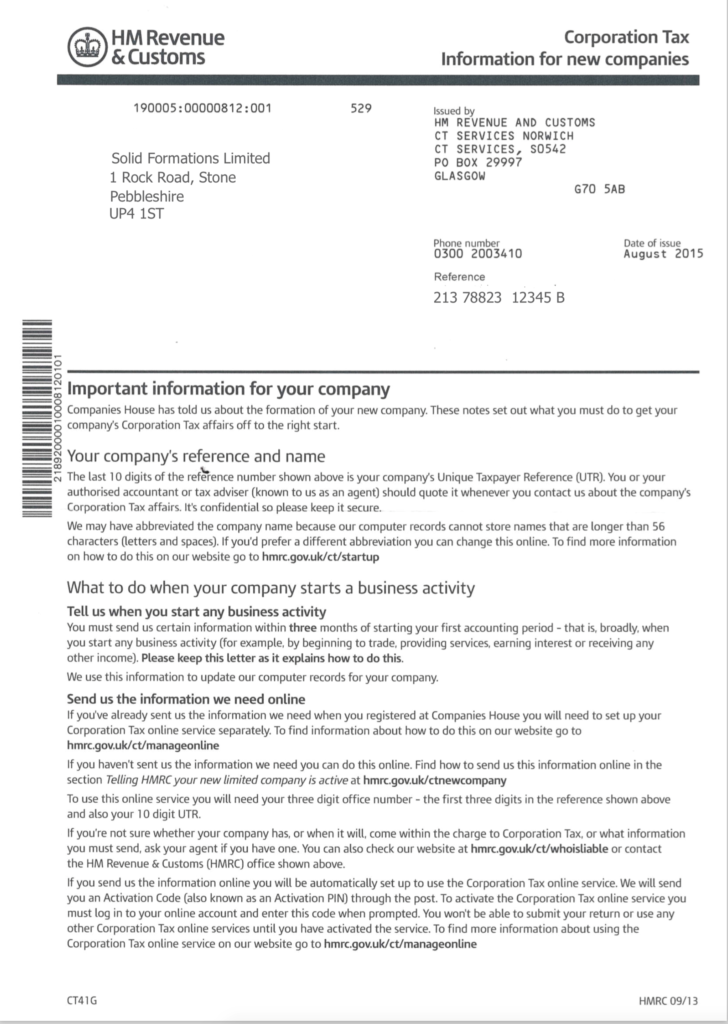

Select the business name you are transferring. For example if you are running your own company you also need to tell HMRC about a change to your business eg. When your new company name has been approved by Companies House you will need to tell HMRC and update your business bank accounts as soon as possible.

The guidance given earlier does not mean that you must change all 64-8s on file. I think you do not need to change anything. To Change Your Address.

Business Name Change. You can also trade using a different name to your registered name. The Construction Industry Scheme CIS.

When you change your business name you may have to change legal documents including contracts loans and your business checking account and checks. Tell HMRC about a change to your business Tell HMRC about changes to your business - a change of name address legal structure or business activity Tell HMRC about a change to your personal details How to tell HMRC if theres a change to your personal details -. You can update your registered trading address with HMRC and all other providers using our Business change of address service.

Business Name Or Trading Name Which Should I Use Debitoor

Business Name Or Trading Name Which Should I Use Debitoor

Choosing A Company Name Trading Name Or Trade Mark Companies House

Choosing A Company Name Trading Name Or Trade Mark Companies House

Changing A Tax Return How Do I Change My Return After Filing

Changing A Tax Return How Do I Change My Return After Filing

How To Tell Hmrc A New Company Is Dormant

How To Tell Hmrc A New Company Is Dormant

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

How To Create An Hmrc Account And Activate Your Paye For Employers Payfit Help Center

How To Create An Hmrc Account And Activate Your Paye For Employers Payfit Help Center

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed In The Uk A Simple Guide

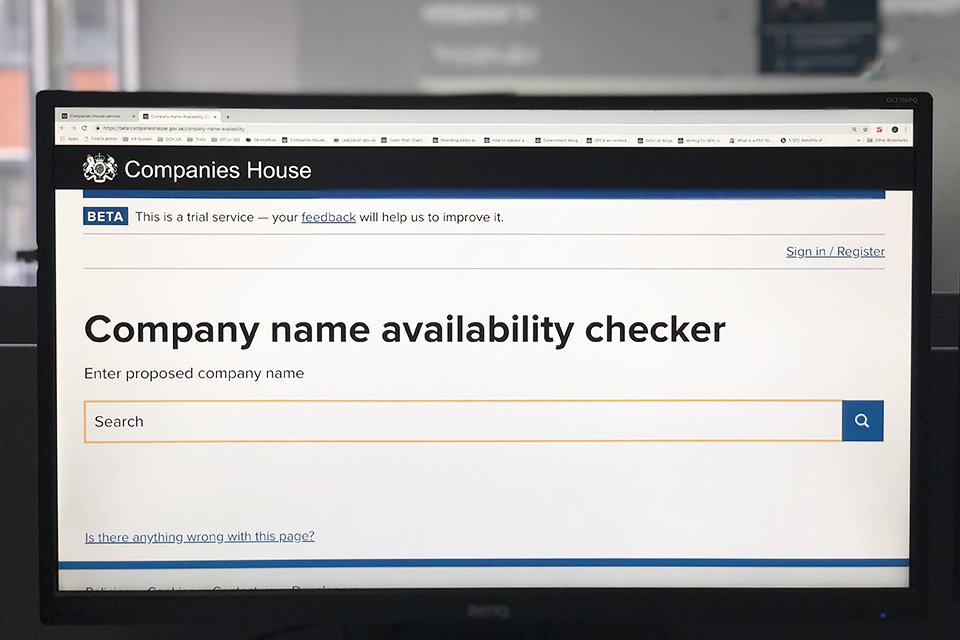

Checking The Public Company Record Companies House

Checking The Public Company Record Companies House

How To Change Your Company Name

How To Change Your Company Name

Business Name Or Trading Name Which Should I Use Debitoor

Business Name Or Trading Name Which Should I Use Debitoor

What Is A Personal Service Company

What Is A Personal Service Company

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

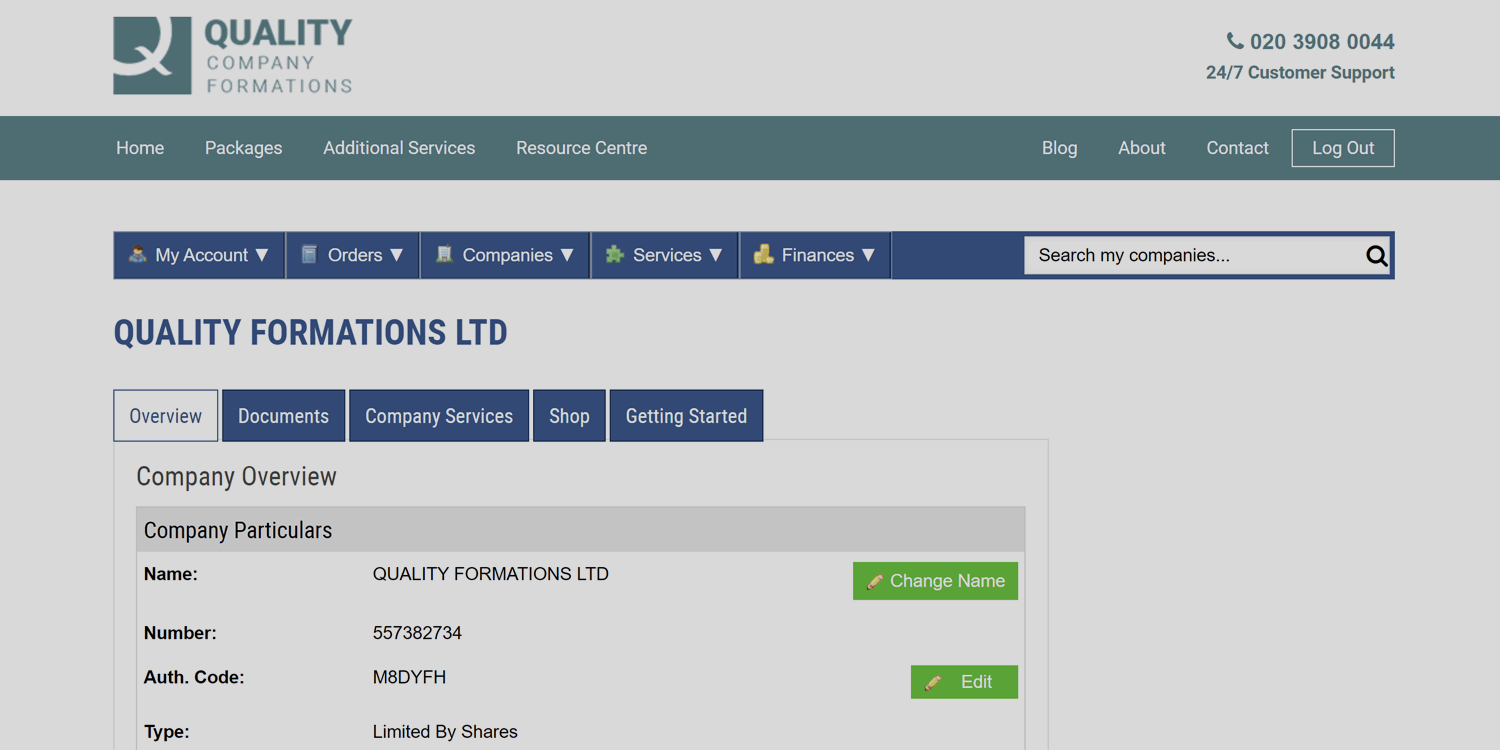

The Company Authentication Code Your Key To Filing Online

The Company Authentication Code Your Key To Filing Online

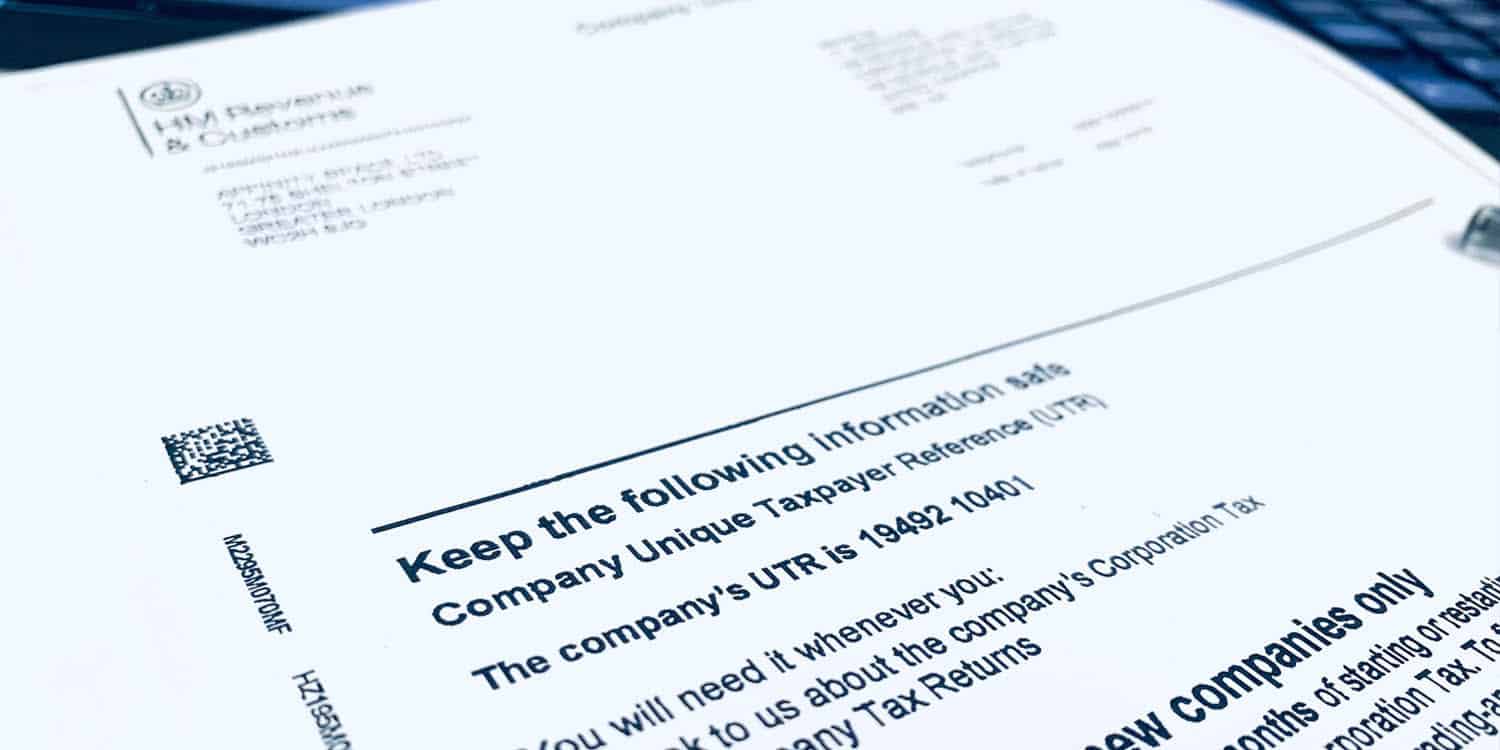

Company Registration Number Crn For The Uk Explained Talk Business

Company Registration Number Crn For The Uk Explained Talk Business

Authorise Quickbooks To Interact With Hmrc Mtd F

Authorise Quickbooks To Interact With Hmrc Mtd F

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Where Can I Find My Company Registration Number Crn

Where Can I Find My Company Registration Number Crn