1099-int Business Loan

You should be receiving a 1098 for the interest paid. You report the interest on schedule B but you dont send anything to the person paying you unless the loan is a mortgage.

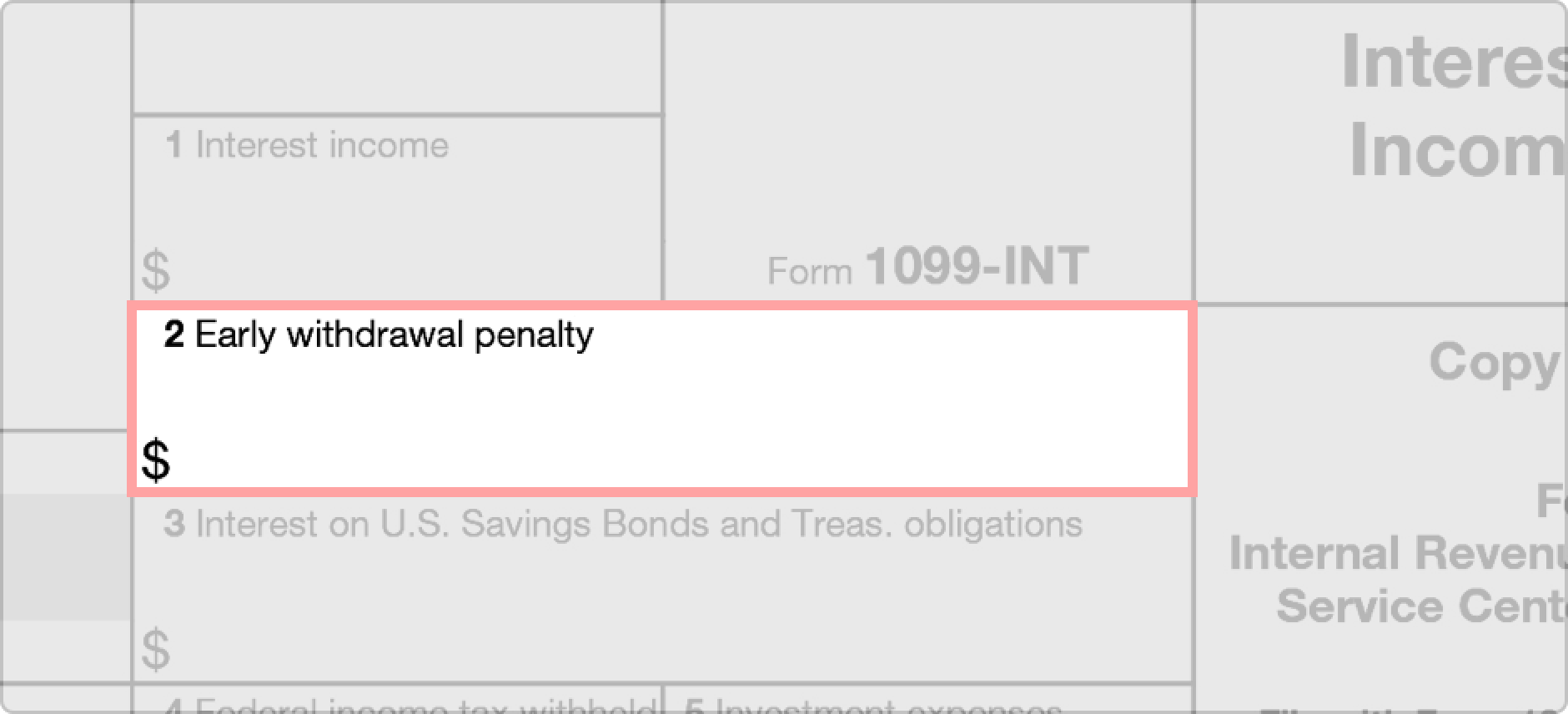

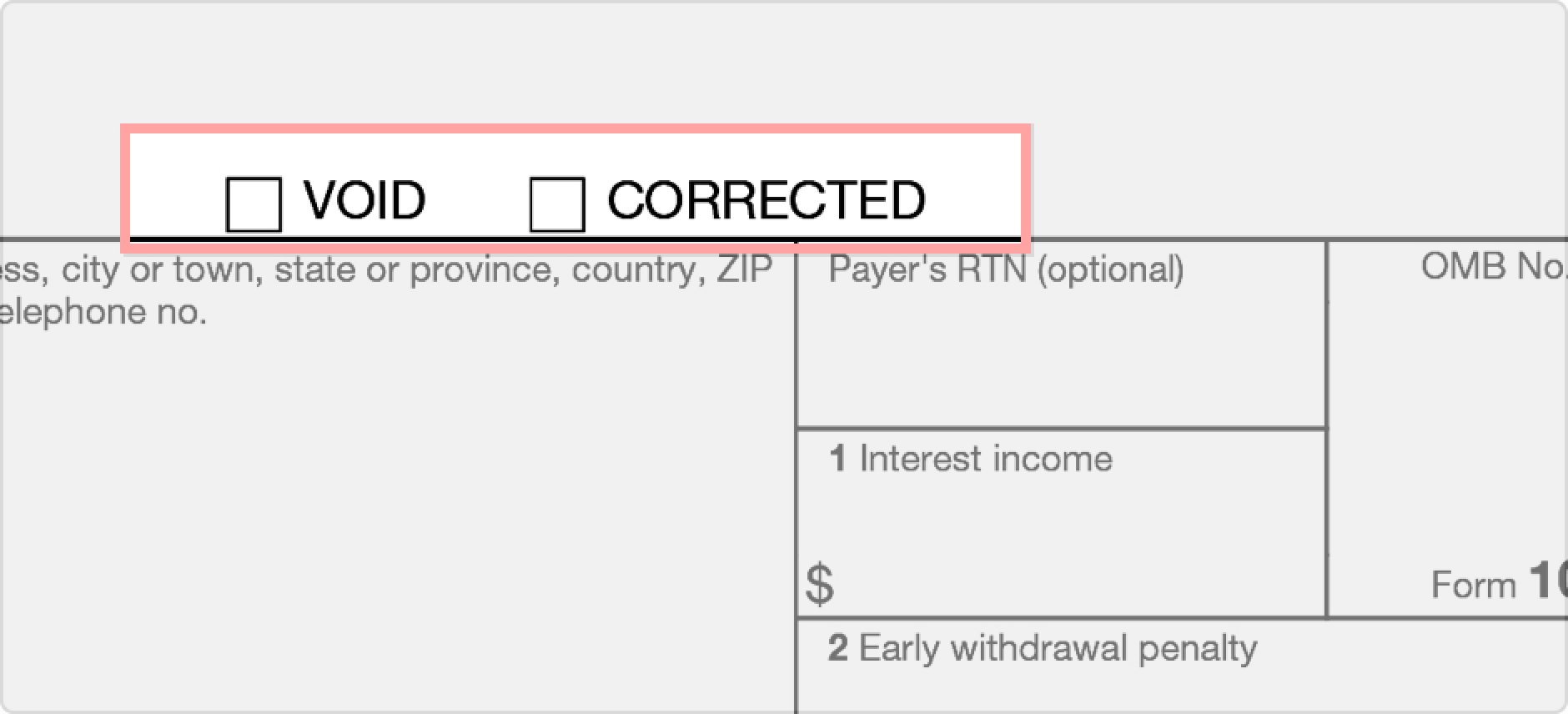

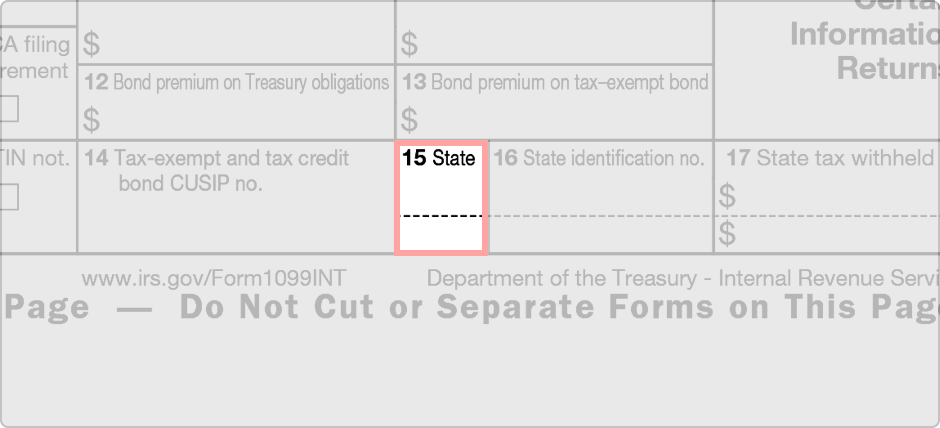

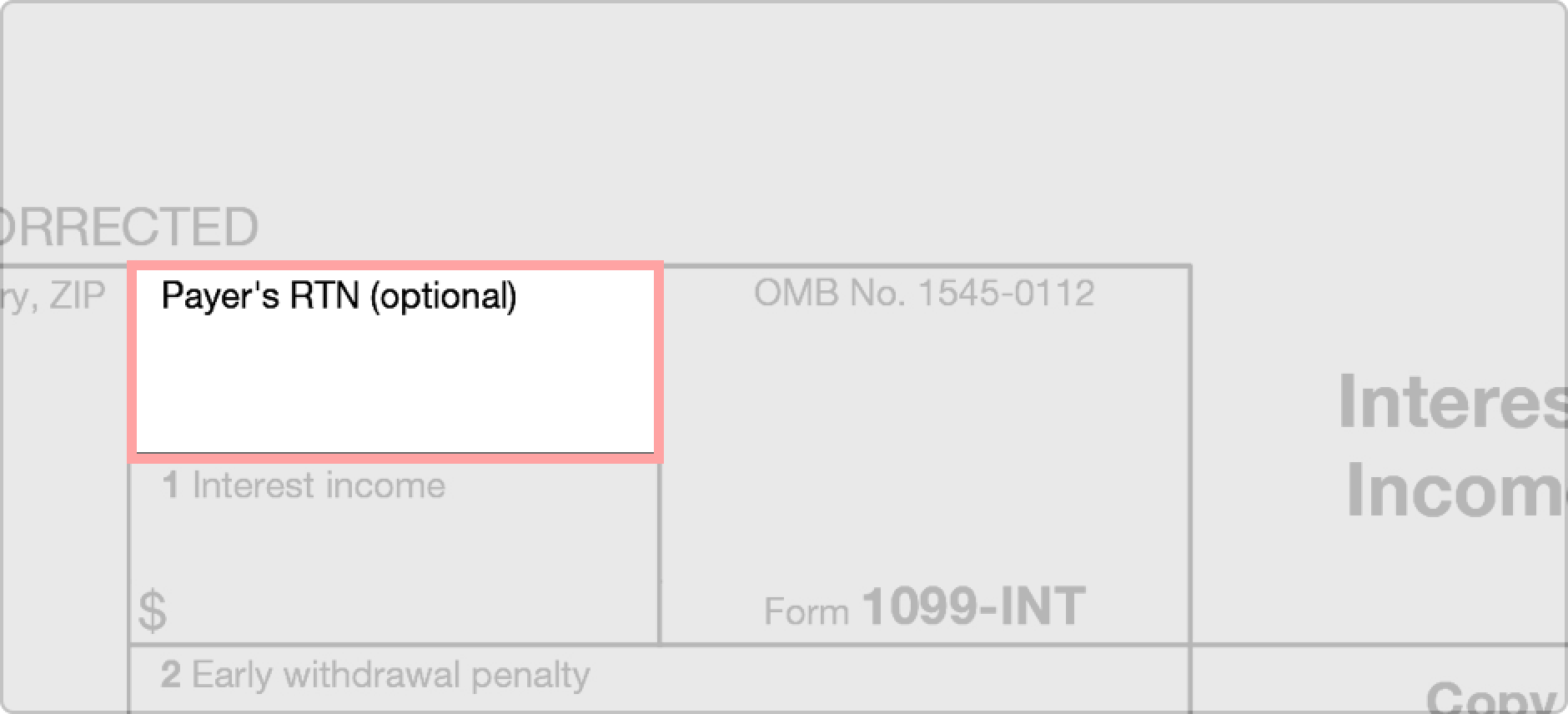

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

Form 1099-INT is the IRS tax form used to report interest income.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

1099-int business loan. The 1099-INT form is used to report interest income. To report this income the borrower who pays the interest completes a Form 1099-INT and submits one copy to the lender and one to the IRS. It would only be if you were in the business OF lending or paying interest bank credit union consumer lending hard money lending etc that the 1099-int is required 1098 actually for lenders 1099-int when interest is PAID.

Form 1099 series is used to report various types of income other than wages salaries and tips for which Form W-2 is used instead. Form 1099-INT and Interest Income Interest income is reported by banks and other financial institutions on Form 1099-INT a copy of which is then sent to you and to the IRS. A copy of Form 1099-INT is sent by the interest payer to both the payee and to the IRS.

File Form 1099-INT for each person. A 1099-DIV is used to report dividend dispersals and a 1099-INT is used to report interest earned of more than 10. You are not required to file Form 1099-INT for interest on an obligation issued by an individual interest on amounts from sources outside the United States paid outside the United States by a non-US.

Payers are required to send 1099s by mail during February in the year that taxes are reported. Since you are NOT in the business of lending money - you cant send them 1099s. If you earned more than 10 in interest from a bank brokerage or.

Check the box that says show results by year. You loaned money made a deposit to Ally the borrowerdebtor is a company 1099-INT is required. You report the interest from your own records.

Report Inappropriate Content. Middleman certain portfolio interest interest on an obligation issued by an international organization and paid by that organization and payments made to a foreign beneficial owner or. Yes the interst paid andor received on a seller-financed loan on an Installement Sale must be included on your income tax return.

Form 1099-INT Interest income typically is reported to the IRS using IRS Form 1099-INT Interest Income. To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. There are other payments that should be reported on a 1099 but they are not as common for small business.

An individual or LLC that you have paid over 10 for interest on a business loan in the form of cash check or wire transfer from your bank account a 1099-INT should be filed. But individuals do not usually have to file a 1099-INT just banks and similar companies. If anybody completes one it is the person paying you the interest.

That isnt too hard to understand - but the different types and amounts of interest does affect the tax form s that you are allowed to use. Form 1099-INT reports the value of taxable interest income any nontaxable interest income and any federal withholding. Unlike the W-2 which report employee income you dont attach 1099s to your federal 1040 tax returns.

Does a business file a 1099-interest on a loan payment that includes interest even if we are not a financial institution. For whom you withheld and paid any foreign tax on interest. If it is not secured by property you should be issuing a 1099-INT for interest paid to that person or business.

If an individual borrows from a company perhaps a bank they do not have to file 1099-INT reporting interest paid perhaps on a credit card. If you have interest income greater than USD 1500 you cant file Form 1040EZ. Then you send form 1098.

1098 is issued to the person who paid interest. You should have an amortization schedule that you should be able to use. 1099-INT is issued to the person who received the interest.

Your obligation is to send a Form 1099-INT to report the interest that you paid her not the total monthly payments. Form 1099-INT Interest Income is the form where interest payments that were made to or are assigned to you are reported. The form is issued by all payers of interest income to investors at year-end.

A 1099-INT tax form is a record that someone a bank or other entity paid you interest. However you can take the tax deductionsexpensesdepreciation for the business of purchasing renovating and selling the properties. From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment.

Youll receive a 1099-INT from each institution that paid you 10 or more in. It includes a breakdown of all types of interest. Same case in the question -- the borrowerdebtor is a company so a 1099-INT is required.

If an individual bank or other entity pays you at least 10 of interest during a calendar year that entity is required to issue a 1099-INT to you.

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

What Is A 1099 Int Tax Form How Do I File It

What Is A 1099 Int Tax Form How Do I File It

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

What Is A 1099 Int 1099 Int Filing Tips

What Is A 1099 Int 1099 Int Filing Tips

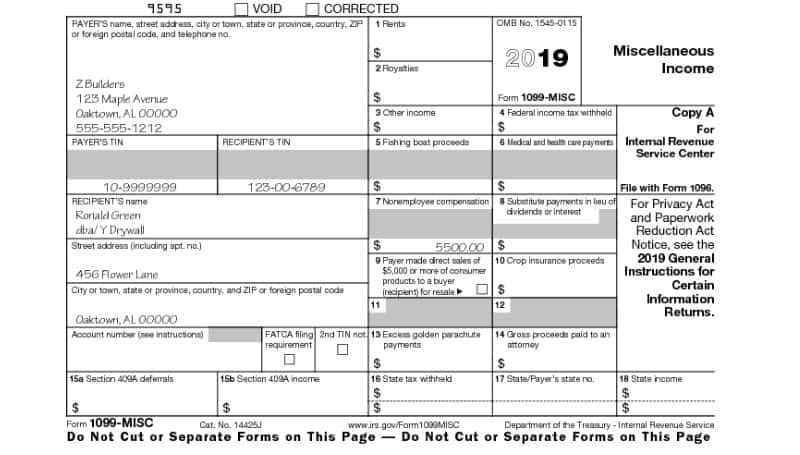

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

Https Www Irs Gov Pub Irs Pdf I1099int Pdf

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions