How To Get My 1099 Form From Unemployment Online

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. For additional questions please review our 1099-G frequently asked questions here.

You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

How to get my 1099 form from unemployment online. The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. Click on the down arrow to select the right year. You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN.

Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. Look for the 1099-G form youll be getting online or in the mail. If you do not have an online account with NYSDOL you may call.

Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in the PU. How to Access Your 1099-G Form Online Log in to your IDES account.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. You can view 1099-G forms for the past 6 years.

Log in to your UI Online account. This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method and Tax Withholding Options. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

You may owe Uncle Sam if. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. It will be available to view in early February on the Online Claims System in the tab titled 1099G Tax forms toward the bottom of the page.

Your 1099-G will be electronically available in your BEACON portal. These forms are available online from the NC DES or in the mail. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment.

If you were a phone filer it will be mailed to you. Lost my pandemic unemployment 1099G form and unable to reset password request copy online. Why is the amount in box one of my 1099G form different from the actual benefit amount I received.

These forms will be mailed to the address that DES has on file for you. After you have successfully logged into your IDES account navigate to the dropdown menu titled Individual Home in orange. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form.

You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. Please note that your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents. Click on View and request 1099-G on the left navigation bar.

You can access your Form 1099G information in your UI Online SM account. If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials. What Do I Do If I Forgot My Uplink.

How to Get Your 1099-G online. To access this form please follow these instructions. Ask Your Own Tax Question.

We will mail you a paper Form 1099G if you. Pacific time except on state holidays. You can log into CONNECT and click on My 1099G49T to view and print the forms.

Click on View 1099-G and print the page. You can receive a copy of your 1099-G Form multiple ways. Unemployment is taxable income.

If this amount if greater than 10 you must report this income to the IRS. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services. No other 1099Gs will be mailed.

Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020. Where to find your 1099G info Your 1099G tax form will be mailed to you by Jan. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter.

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

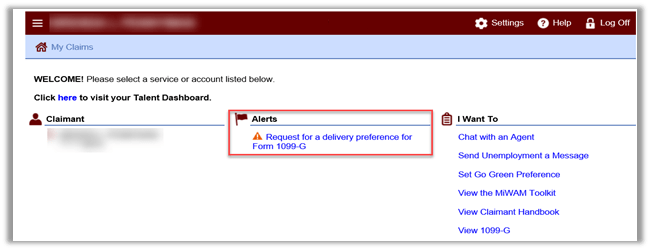

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

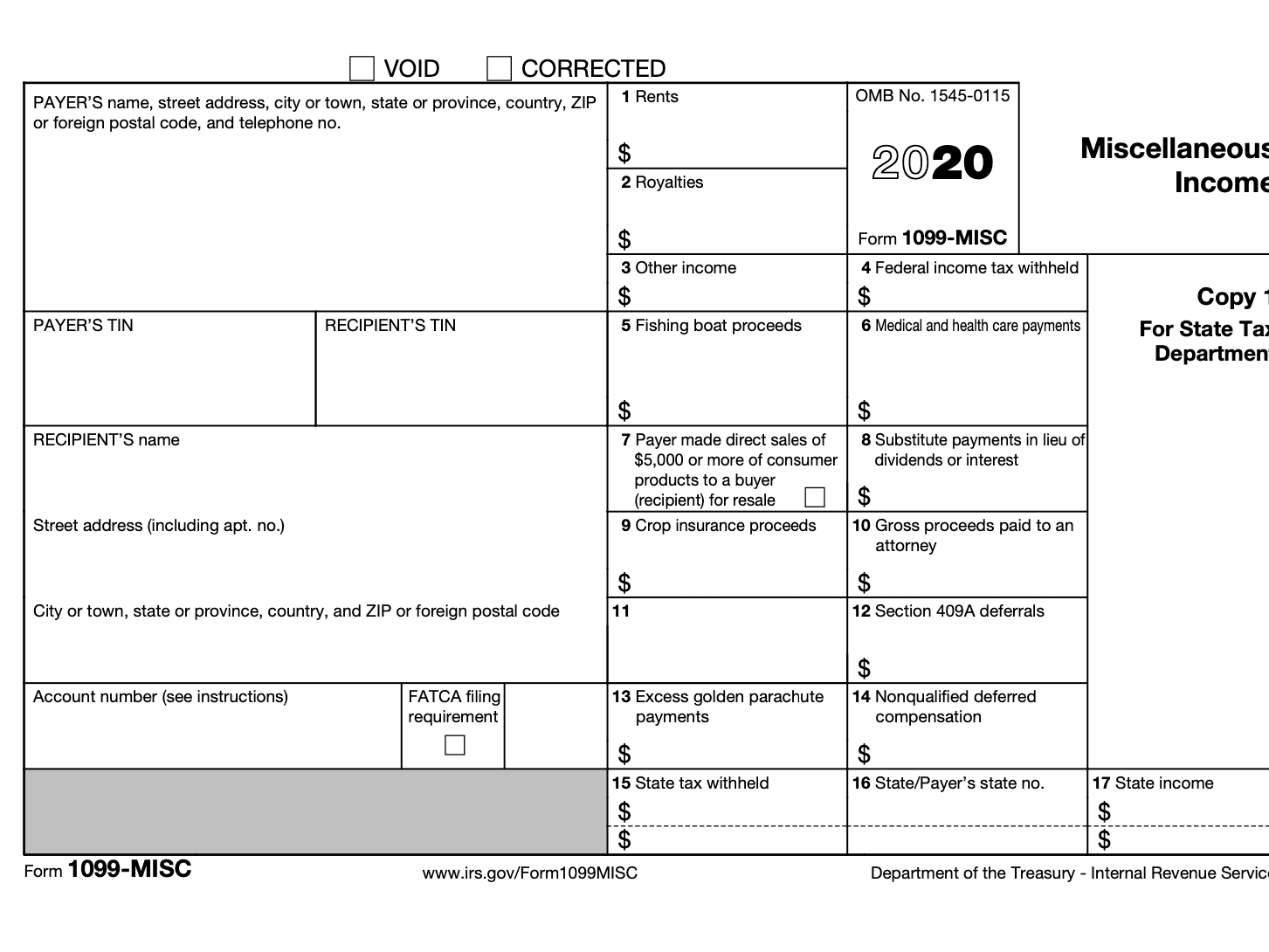

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training