Business Code For Futures And Options In Itr

Tax rules treat gains from FO trading as business income and not capital gains. As these are considered non-speculative business gains income tax is levied according to.

Itr Form For Trader And Investor Learn By Quicko

Itr Form For Trader And Investor Learn By Quicko

Both incomes or losses that arise from trading of futures and options has to be treated as a business income or loss and requires filing of returns using the ITR-4 tax form.

Business code for futures and options in itr. Taxable income after deductions is also taxed. You may have filed ITR-1 or ITR-2 before but you must check ITR form applicability every year based on each income earned in that year. Those who trade in Futures Options find tax filing a big hassle.

Income from futures and options is business income if trading is regular August 25 2020 430 AM The nature of compensation received by you is not clear from the facts stated. In such a case you have to use ITR-3 form which is more complex. 22 July 2018 Please provide the business code for trading in futures options intraday tradingshares etc for AY 2018-19.

Filing of income tax returns with regards to any income earned from the trading in Futures and Options is by and. What is to be mentioned as the nature of business on ITR 3 ITR 4 until 2017. Income from FO deals is almost always treated as business income.

In new list of codes There is no specific code for share trading. Options Turnover Absolute Profit Premium obtained on selling the options. Any chance of extending belated itr for ay20-21.

Please suggest code for business of trading in shares futures and options - Income Tax. Taxation of Income And Loss Arising From Trading of Futures And Options. 1 crore a tax audit takes place.

While arriving at the income or loss from trading of stocks taxpayers are allowed to deduct the expenses related to trading such as internet charges telephone charges brokers commission demat account maintenance charges advisory fees paid to broker as business. Consequences of treating income as capital gain. Is it 13010-Investment Activities.

And have to file ITR-4 to report this income From FY 16-17 ITR 3 is the new name for ITR-4 so from the said year ITR-3 needs to be filed for FO trading incomelosses. But from this AY. When income or profits obtained from the trading of futures and options is treated as capital gain following consequences take place.

Gains from FO are not considered capital gains but business income. Many do not report if they have FO losses. Earlier 0204 - Trading-others was used as the business code for share trading activities.

Since income from FO enjoys the presumptive scheme of taxation you can use the relatively simpler ITR 4 as well. 0204 until 2017. Please suggest code for business of trading in shares futures and options - Income Tax.

Other financial intermediation services nec-Code. For the financial year 2018-19 an individual had loss from futures options trading which was claimed in the ITR which was filled within the due date but the Income Tax Department has not considered the loss from futures options trading and raised a demand by adding back the same to the total net income as it was not mentioned in the PL. But not reporting FO gains or losses can.

Individuals can have business income too. The task is going to be even more difficult if you trade in the future and options segment derivative segment of equity or commodities market. 201819 new list has been introduced by department.

In cases where the income from futures and options is above Rs. Retail sale of other products nec -Code. According to income tax rules in India gains from FO trading are treated as business income and not capital gains.

For FY 201718 Code. But if you also played the derivative market and made some money or incurred losses in futures and options get ready to use the more complicated ITR 3. As Futures options FO is treated as normal business income so if the total sales turnover or gross receipt from business for the previous year relevant to.

Options and futures are alike but when you do an options contract you can choose to not make the transaction. 13010 Financial intermediationInvestment activities. This loss can be set off against future capital gains.

372 rows Kindly confirm the Business code for FO Trading in the ITR3. Nature of business can be mentioned as Trading-Others Code. So to my v.

Dear Sir What code should be used Nature of Business for business income from trading in derivatives futures and options while filing ITR 3 for FY 2017 18 Kindl. FO Losses and Tax Audit. Futures Turnover Absolute Profit sum of profit and loss made on various transactions throughout the year The turnover of options can be calculated by adding the premium obtained on selling the options to the absolute profit.

By Karan Batra Filing income tax returns is easy if you have income only from salary and bank interestHowever many taxpayers also have income from other sources including gains from trading in futures and options FO. This seems to be the closest category to.

Income Tax Return For Share Traders Intraday Trading F O Trading Capital Gain And Salary Youtube

Income Tax Return For Share Traders Intraday Trading F O Trading Capital Gain And Salary Youtube

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

New Income Tax Return Forms For Ay2021 22 Notified Here Are A Few Changes That Matter

New Income Tax Return Forms For Ay2021 22 Notified Here Are A Few Changes That Matter

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

How Can I File Future And Option Loss In Itr Tax Benefits Of Reporting Loss On F O In It Returns Youtube

Mistakes While Filing Itr And Checklist Before Submitting Itr

Mistakes While Filing Itr And Checklist Before Submitting Itr

Income Tax Return Here S All You Need To Know Before Filing Itr For Ay19 20 Cnbctv18 Com

Income Tax Return Here S All You Need To Know Before Filing Itr For Ay19 20 Cnbctv18 Com

How To Get Your Pan Reprinted Income Tax Growing Wealth Fact And Opinion

How To Get Your Pan Reprinted Income Tax Growing Wealth Fact And Opinion

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

How To File Income Tax Return Ay 2020 21 E Filing In Telugu Complete Information Youtube

How To File Income Tax Return Ay 2020 21 E Filing In Telugu Complete Information Youtube

Last Day Of Filing Itr I T Returns Filing Crosses 6 Crore Mark

Last Day Of Filing Itr I T Returns Filing Crosses 6 Crore Mark

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

Intraday Trading Loss F O Loss And Capital Gain In Itr Ay 2020 21 Income Tax Return Share Market Youtube

Pin By The Taxtalk On Income Tax Scrip Confused Wise

Pin By The Taxtalk On Income Tax Scrip Confused Wise

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube

Tax Refund Income Tax Return Tax Return Tax

Tax Refund Income Tax Return Tax Return Tax

Income Tax Return Here S All You Need To Know Before Filing Itr For Ay19 20 Cnbctv18 Com

Income Tax Return Here S All You Need To Know Before Filing Itr For Ay19 20 Cnbctv18 Com

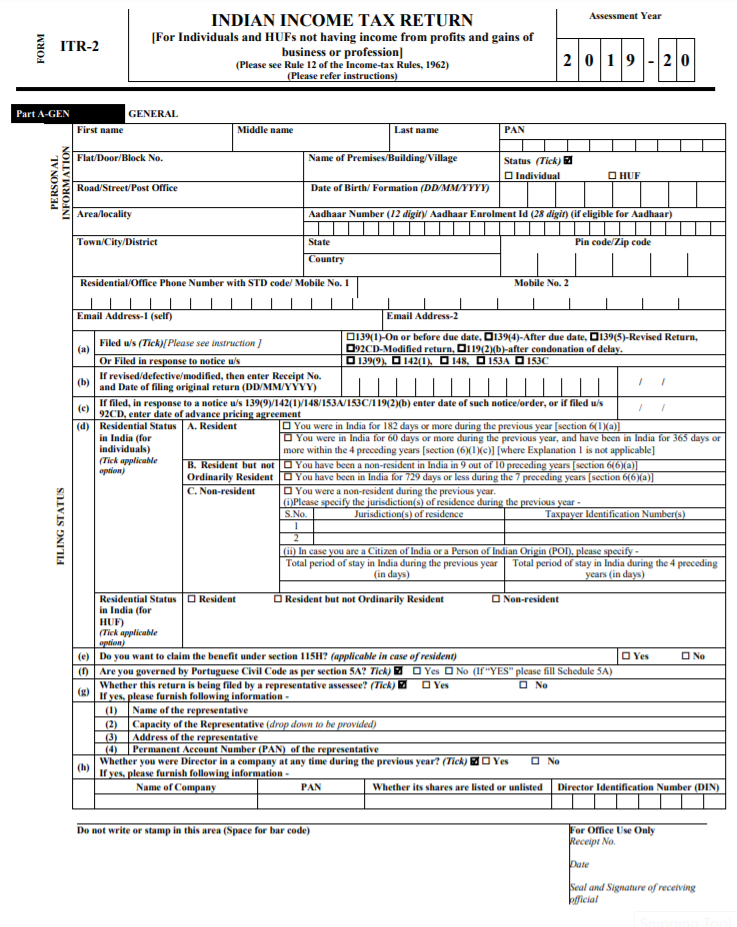

Income Tax Salary Plus Capital Gains File Itr 2 And Get Standard Deduction The Financial Express

Income Tax Salary Plus Capital Gains File Itr 2 And Get Standard Deduction The Financial Express

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube

Itr3 How To File Itr 3 For Income From Business And Profession 2017 18 Hindi Itr 4 Is Now Itr 3 Youtube