How To Get Your W2 Without Contacting Employer

After SSA processes it they transmit the federal tax information to the IRS. If the form is lost missing or you cant find it online contact your employer immediately.

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Your tax return is normally due on or before April 18 2016.

How to get your w2 without contacting employer. If its after February 14 with no help or response from your employer the IRS can assist you at 800-829-1040. The quickest way to obtain a copy of your current year Form W-2 is through your employer. You can call your ex-employer to request your W-2 form.

There are many reasons why you might not receive an IRS W-2 including administrative glitches and simple oversights. Contact the IRS and advise the representative that you need a copy of your tax transcript. You can use your final pay stub for these amounts.

You should first ask your employer to give you a copy of your W-2. You can find this number on your last pay stub on last years form. File Your Taxes No Matter What.

If your employer cant give you your lost W-2 Forms you can get a copy of your Form W-2 from the Social Security Administration for a fee. See the article below for more information. In a case where you already contacted the IRS regarding your missing W-2 they will get you to complete Form 4852 which will function as a Form W-2.

Contact your employer first. We use cookies to give you the best possible experience on our website. After February 14 you may call the IRS at 800-829-1040 if you have not yet received your W-2.

- Answered by a verified Career Counselor. The W 2 form is usually mailed to you or made accessible online by the company you work for. According to the IRS you still have to file your tax return or request a tax extension by April 15.

How can i get my W2 without contacting my employer. Where Is My W-2. The IRS will then send a reminder notice to your previous employer.

How to Get W2s Without Going Through the Employer Step 1. If you cant get in touch with your employer to get a W-2 you can reach out to your local IRS Taxpayer Assistance Center TAC. They will also issue you a Form 4852 to fill out.

Failing that you can also download Form 4506-T which has a breakdown of the W-2 information that has been reported by your employer. Its a good idea to call the IRS if you dont receive the W2 by mid-February. Your employer first submits Form W-2 to SSA.

You can call the IRS at 800829-1040. Ask your employer or former employer to send your W-2 if it has not already been sent. You will need to have complete information on the employer and you available for the IRS employee including when you work at the employer and estimates of.

The IRS recommends waiting until February 14 before taking any action if you have not received your W2. If you cant access your myPay account you can submit a tax statement request via askDFAS and well mail you a hard copy. Give the IRS representative the specific year for which you need W2 information.

Make sure your employer has your correct address. Alternatively request Form 4852 as this allows you to estimate your wages and deductions based on the final payslip received. You can also contact the IRS by requesting a wage and income transcript directly from the IRS you will not get state and local information State and local information is not included on the W-2 that is requested through the wage and income transcript.

How to get your W2 Filing taxes after youve separated If youve separated within 13 months you can login to your myPay account to get your W2. You can find this in your last pay stub or last years W-2 if you received one from the company. Your employers name address and phone number.

The IRS will contact your employer and request the missing form. To make it simple on everyone locate your companys Employer Identification Number EIN. If you still cant get your W-2 or a copy of it it is time to call the IRS.

Youll also need this form from any former employer you worked for during the year. I tryed to contact them but for some reason They cant be found. But wait until after February 14th.

An estimate of your wages and federal income tax withheld in 2015. If you have not received your W-2 follow these three steps. If you exhaust your options with your employer and you have not received your W-2 call the IRS at 800-829-1040.

The IRS will use your name Social Security number estimate of wages and estimate of federal income tax withheld to try to help you. To make it easier for the IRS give them your previous companys Employer Identification Number. The dates you worked for the employer.

If your employer no longer exists or cant provide you with the W-2 in a timely manner you can call the IRS directly at 800-829-1040. Just File Your Return Without The W-2 It doesnt matter if you have your W-2 or not. If employers send the form to you be sure they have your correct address.

Once you have contacted them the IRS will follow up with the employer. Use Form 4852 Substitute for Form W-2 Wage and Tax Statement if you dont get your W-2 in time to file.

The Islanders Blog 6 Things We Learned About The Irss Fight Against Fraud And Identity Theft Identity Theft Customer Service Strategy Tax Refund

The Islanders Blog 6 Things We Learned About The Irss Fight Against Fraud And Identity Theft Identity Theft Customer Service Strategy Tax Refund

Made A Mistake On Your Tax Return 15 Things You Need To Know

Made A Mistake On Your Tax Return 15 Things You Need To Know

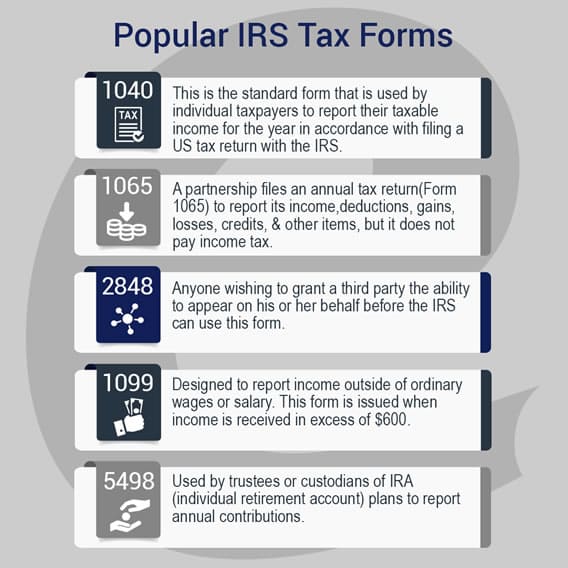

Irs Tax Forms 1040ez 1040a More E File Com

Irs Tax Forms 1040ez 1040a More E File Com

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Life Insurance

How To Get Your W 2 From A Previous Employer

How To Get Your W 2 From A Previous Employer

4 Things To Do If You Don T Get Your W 2 On Time Primepay

4 Things To Do If You Don T Get Your W 2 On Time Primepay

When To Expect Your Forms W 2 1099 More In 2016 And What To Do If Your Tax Forms Are Late

When To Expect Your Forms W 2 1099 More In 2016 And What To Do If Your Tax Forms Are Late

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

What To Do If You Haven T Received A W 2 Turbotax Tax Tips Videos

Dj Business Kit Disc Jockey Business Forms Dj Business Etsy In 2021 Power Of Attorney Form Dj Business Printables

Dj Business Kit Disc Jockey Business Forms Dj Business Etsy In 2021 Power Of Attorney Form Dj Business Printables

A Handy Guide For View My Paycheck Not Working Quickbooks Data Services Paycheck

A Handy Guide For View My Paycheck Not Working Quickbooks Data Services Paycheck

What To Do If You Are Missing A W 2 Did You Receive Your W 2 These Documents Are Essential Accounting Services Professional Accounting Bookkeeping Services

What To Do If You Are Missing A W 2 Did You Receive Your W 2 These Documents Are Essential Accounting Services Professional Accounting Bookkeeping Services

How To File Your Taxes Without A W 2 The Official Blog Of Taxslayer

How To File Your Taxes Without A W 2 The Official Blog Of Taxslayer

Tips That You Can Check To Compile All Your Employment History Reports Employment Human Resources Resignation

Tips That You Can Check To Compile All Your Employment History Reports Employment Human Resources Resignation

How To Get Your W 2 From A Previous Employer

How To Get Your W 2 From A Previous Employer

Https Internetnir Blogspot Com 2016 12 What To Do If You Dont Have Your W2 Form Html The W 2 Form Is A Vital Piece Of Info For Most Tax Filers As It Confirms

Https Internetnir Blogspot Com 2016 12 What To Do If You Dont Have Your W2 Form Html The W 2 Form Is A Vital Piece Of Info For Most Tax Filers As It Confirms

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block