Business File 1099 Electronically

File 1099 Misc Form Electronically. You must register with the FIRE system by filing an online application.

The efile document istxt file.

Business file 1099 electronically. Modernized e-File MeF Internet Filing MeF Internet filing is available for charities and non-profits corporations and partnerships. You must register with the system and get a transmission code. Electronic Payment Options Home Page e-file for.

EFTPS - Electronic Federal Tax Payment System. This is why we decided to dedicate this section of our website to 1099 electronic filing and any related information. File 1099 online securely with our efile for business service.

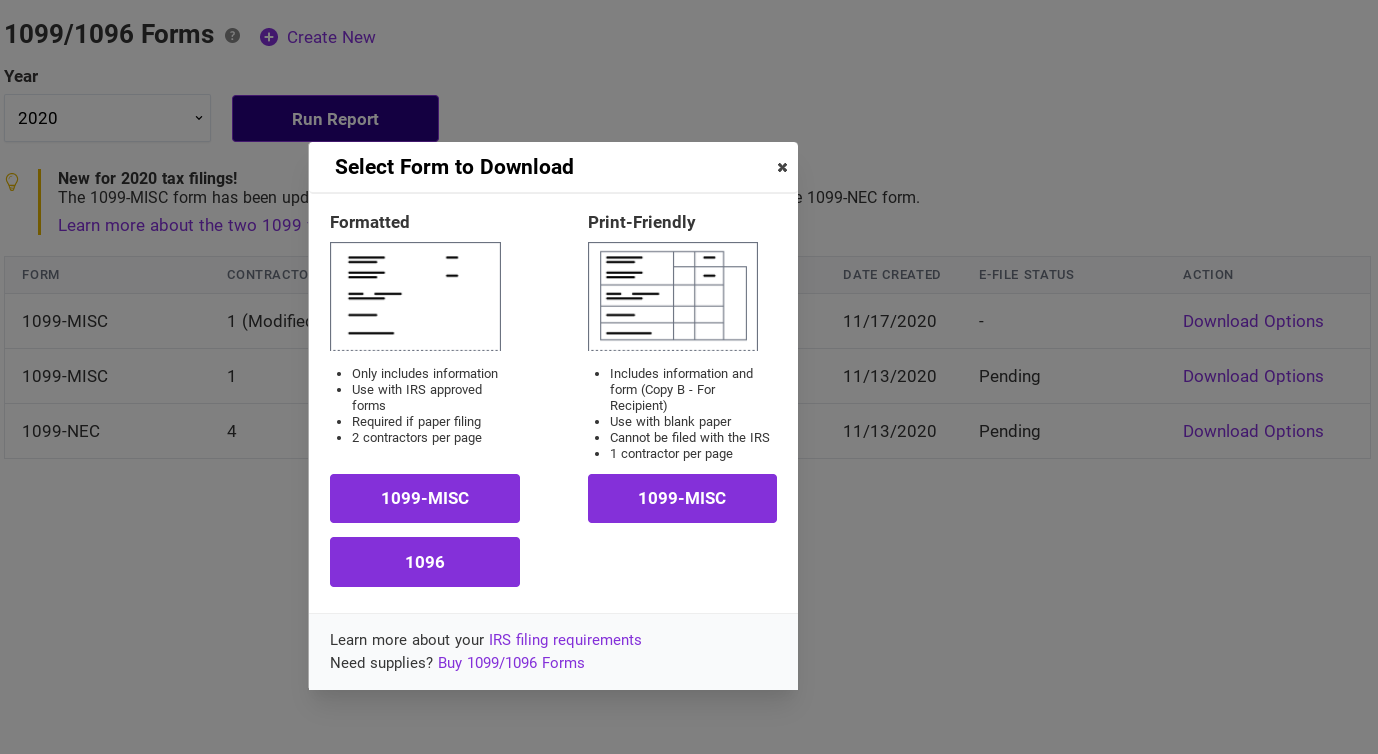

You do not need to request an extension to file with us if you file electronically under the IRS Combined FederalState Filing Program. Therefore you do not need to send a 1096 form to the government for the 1099 forms e-filed. E-Filing 1099 Forms With the IRS.

Print mail and file 1099 W-2 1098 1042-S tax forms to recipients without software. Filing Information Returns Electronically FIRE Forms 1099 1098 W-2G more Modernized e-File MeF for Partnerships. For more details check out the IRSs Filing Information Returns Electronically.

1099-B filers We allow extensions on filing 1099-B records up to 90 days. It is your unique ID to file the 1099s tax forms to IRS electronically. 1099 Reporting While it is not statutorily required for employers to provide their 1099 files electronically beginning 2018 for tax year 2017 Missouri will be accepting 1099 files through the same upload process being utilized for W-2 reporting.

The IRS lets businesses annually file their 1099 forms electronically also known as e-File instead of manually printing paper copies and sending them to the IRS. If you are filing electronically you will use the form online. The Missouri 1099 Reporting Requirements and Specification Handbook.

We dont accept information returns in any other format. Businesses that issue 1099s must also submit their information returns using iWire. The deadline for filing W-2s and 1099-NEC is January 31 of the.

You can file all types of 1099 forms online by using the IRS Filing Information Returns Electronically FIRE system. Quick Employer Forms FAQs. Electronic filing requirements W-2s and 1099s.

The web address for this free service is httpsfireirsgov. QuickBooks Payrolls 1099 E-file service is easy accurate and on time. E-file with the IRS on time--even on deadline day.

QuickBooks Payrolls 1099 E-file service is easy accurate and on time. Follow these steps to prepare and file a Form 1099. If you are new user of IRS EFILE service you need to apply TCC code Transmitter Control Code to generate the efile document.

We offer 1099 EFile software for business filers and we found out that our users and potential customers keep coming back with the same questions every year. You can submit all 1099 forms including Form 1099-NEC to the IRS by mail or online using the Filing Information Returns Electronically FIRE system. If you are filing 250 or more information returns 1099s and other types in a year you must use the FIRE system but others are encouraged to use it too.

The IRS 1099 E-File service also referred to as IRS FIRE System is free online service available from the IRS to allow business filers to send 1099 forms data electronically to the federal government and some state tax departments. Electronic filing or e-filing is an online method of filing form 1099-MISC. They cannot be downloaded from the website they are only available for informational purposes.

Our helpline number 1 -316 -869-0948 you can easily receive any information about federal tax 1099 Misc form. Prepare and File a 1099 1099 forms are only filed on paper so you cannot prepare and eFile a 1099 online. You can file your 1099s online with QuickBooks for the easiest filing ever But if you plan to send in the 1099 form via mail these forms must be ordered in hard copy format.

Businesses and payroll service providers must submit all W-2s electronically using iWire. It includes the 1099 forms and 1096 form. Below youll find all the information regarding online filing and the process for having it done in just a few minutes with an IRS-authorized agent.

Yes if you used the online service Quick Employer Forms to e-file your 1099 forms to the federal government the summary information equivalent to the printed 1096 required is sent electronically as well with the 1099 file. Obtain a blank 1099 form which is printed on special paper from the IRS or an office supply store. Avoid late fees and late forms.

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Electronically File Irs Form 1099 Misc Youtube

How To Electronically File Irs Form 1099 Misc Youtube

1099 Electronic Filing Software 289 To Efile

1099 Electronic Filing Software 289 To Efile

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 G Software To Create Print E File Irs Form 1099 G

1099 G Software To Create Print E File Irs Form 1099 G

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

Electronically File 1099s Patriot Software

Electronically File 1099s Patriot Software

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Filing Deadlines For 1099 Misc And 1099 K

1099 Filing Deadlines For 1099 Misc And 1099 K

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

Federal And State Filing For 1099 Nec

Federal And State Filing For 1099 Nec