Where Do I Mail My 1099

Follow these steps to meet your 1099-MISC deadline. If you lost your 1099 form your first instinct might be to panic.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Even if you lose a Form 1099-MISC for miscellaneous income or 1099-NEC you can replace or still file your tax return without delay.

Where do i mail my 1099. No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. Box 942840 Sacramento CA 94240-6090. For added convenience select the postal mailing option and allow ExpressEfile to handle all your recipient copies.

Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. You should receive a Form 1099-MISC from all payers for any services you provided that were in excess of 600 for the year but this does not always happen.

PA Department of Revenue. 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. The IRS address you should mail Form 1099-NEC to depends on your state.

If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office. We recommend you file Form 1099-MISC as a stand-alone shipment by January 31 2019 if you are reporting nonemployee compensation NEC in box 7 which I am. Box 1 of the 1099-INT reports all taxable interest you receive such as your earnings from a savings account.

For example if you were paid 450 for doing contract work for a client the client is not mandated by the IRS to supply you with a 1099-MISC. State-Specific Guidance for Form 1099-NEC Filing Form 1099-NEC with the states may be different than you are used to though. Box 2 reports interest penalties youre charged for withdrawing money from an account before the maturity date.

Examples of this include freelance work or driving for DoorDash or Uber. Transmit Form 1099-MISC Directly to the IRS. Do not also send in federal Form 1099-R.

How to mail 1099-MISC. Savings bonds or Treasury notes bills or bonds. This tax season millions of independent workers will receive Form 1099-NEC in the mail for the first time.

Get your filing status instantly. If you are paid as a contractor by one or more of your clients you will receive the 1099-NEC but you do not need to send it to the IRS. If you are not e-filing then mail your statements with your entire tax return to your local IRS office.

Where to File Paper Tax Returns With or Without a Payment. My Social Security Replacement SSA-1099. 8 hours ago1099-MISC and 1099-NEC.

You need to report what you were paid of course but you do not need a Form 1099 to do that just report your income. Mail 1099-MISC forms to. If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am.

For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for. The General Instructions for Certain Information Returns say. The IRS address you should mail Form 1099-NEC to depends on your state.

Previously nonemployee compensation was reported on Box 7 of Form 1099-MISC but the IRS has recently released Form 1099-NEC to replace that option. You can either file 1099-NEC electronically with the IRS using the IRS FIRE system or you can mail it to your local Department of the Treasury Internal Revenue Service Center. Enter your Information Easily.

Box 3 reports interest earned on US. Keep it for your records. Thats because you dont have to file your 1099s with your income tax return like you do forms W-2.

ExpressEfile makes filing Form 1099-MISC online easy. This may delay processing of your return. Form 1096 must accompany all paper submissions But the instructions for Form 1096 say.

If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to. The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Bureau of Individual Taxes.

And a useful cross-check is to ask the IRS for a transcript of your account. Here is your state-by-state address guide. You are not required to mail forms W-2 to the State of California.

Franchise Tax Board PO.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

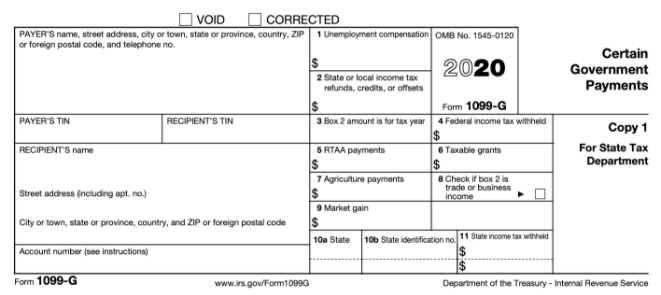

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster