How To Create 1099 For Contractor

The most important distinction to make is whether people work in an independent contractor capacity or if they work in a common law employeremployee capacity. You cannot use a.

A 2021 Guide To Taxes For Independent Contractors The Blueprint

A 2021 Guide To Taxes For Independent Contractors The Blueprint

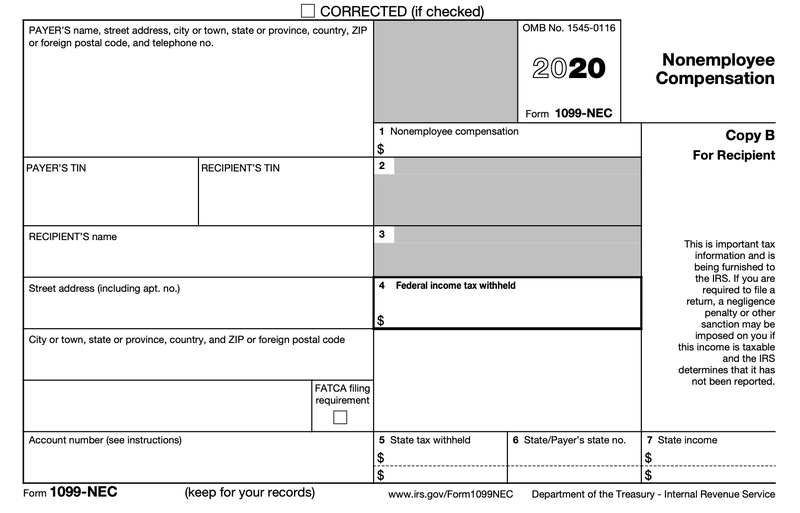

Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC.

How to create 1099 for contractor. Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. For information on estimated tax payments refer to Form 1040-ES Estimated Tax for Individuals. Select the vendor by clicking the name.

When youre done select Add contractor. You can change the designation by following the steps below. Must I file quarterly forms to report income as an independent contractor.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. Why and How to Create an Independent Contractor Handbook. You may need to make quarterly estimated tax payments.

This article will dive into the differences and what criteria is most important to look at when making a decision on how to classify your workers. Before you start the 1099 process make sure you have all the correct information on your. On the Vendor Information screen place a check mark on the box next to Track payments for 1099.

First understand that there are a lot of things you DONT NEED to do when starting a business. A 1099 contractor is a person who works independently rather than for an employer. Go to the Payroll menu then select Contractors.

So how do I prepare the 1099s. Now that we have that out of the way lets talk about starting your independent contractor business. Go to the Payroll menu then select Contractors.

Enter your contractors info or select the Email this contractor checkbox so they can fill it out. Select Prepare 1099s and then Lets get started. 1099 MISC Independent Contractors and Self-Employed 4 Question.

Independent contractors consultants contract workers 1099 employees and outsourced staff. The amount of income paid to you during the year in the appropriate box based on the type of income you received 4. The name address and taxpayer ID number of the company or individual who issued the form 3.

Once you have accurate information to work with its time to get your 1099s. The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors. Payers use Form 1099-MISC Miscellaneous Income or Form 1099-NEC Nonemployee Compensation to.

All of these are names used to refer to individuals who work for you but are paid outside of payroll. Go to Expenses and choose Vendors. If the following four conditions are met you must generally report a payment as nonemployee compensation.

There are significant differences in the legalities of a contractor and employee. Starting in 2020 the IRS now requires payments to independent contractors are shown on a new form 1099-NEC non-employee compensation instead of the 1099-MISC miscellaneous. Track contractor payments for 1099s.

Fill out the forms. Click the Edit button at the top of the screen. Or select Expenses and then Vendors.

Lesa Hammond CEO ProfHire Inc. First Steps to Becoming an Independent Contractor. While the work can be similar in nature it is important to follow the law with regard to taxes payments and the like.

Your name address and taxpayer ID number 2. Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. Now that you entered the contractor as a vendor you need to start tracking their payments.

The 1099-MISC Form generally includes. Select Add a contractor. Make sure your company name address and tax ID matches is correct and matches what is found on tax notices or letters from the IRS.

If you hire 1099 workers directly rather than through an employment agency you will need to set up the following IRS paperwork. Assuming you pay your contractor more than 600 in any calendar year you will need to send a copy of the 1099-NEC to the contractor and the IRS by January 31.

How To Pay Contractors And Freelancers Clockify Blog

How To Pay Contractors And Freelancers Clockify Blog

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Invoice Template Word Invoice Example

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

1099 Form Fillable Independent Contractors Vs Employees Not As Simple As 1099 Tax Form Tax Forms Fillable Forms

Independent Contractor Billing Template Elegant Irs 1099 Forms For Independent Contractors Form Invoice Template Business Budget Template Invoice Template Word

Independent Contractor Billing Template Elegant Irs 1099 Forms For Independent Contractors Form Invoice Template Business Budget Template Invoice Template Word

1099 Invoice Template New 1099 Contractor Invoice Template Seven Things That You Invoice Template Estimate Template Timesheet Template

1099 Invoice Template New 1099 Contractor Invoice Template Seven Things That You Invoice Template Estimate Template Timesheet Template

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

Small Business Tax Preparation For Independent Contractors

Independent Contractor Invoice Template Free Beautiful 7 Independent Contractor Invoice Invoice Template Estimate Template Excel Budget Template

Independent Contractor Invoice Template Free Beautiful 7 Independent Contractor Invoice Invoice Template Estimate Template Excel Budget Template

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Learn More About 1099 Misc Regarding Business Expenses For Independent Contractors At Nathan Gibson S Business Expense Best Tax Software Independent Contractor

Learn More About 1099 Misc Regarding Business Expenses For Independent Contractors At Nathan Gibson S Business Expense Best Tax Software Independent Contractor

1099 Invoice Template Beautiful Independent Contractor 1099 Invoice Template Invoice Template Invoicing Templates

1099 Invoice Template Beautiful Independent Contractor 1099 Invoice Template Invoice Template Invoicing Templates

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Work On Yourself Printables

Do You Have Independent Contractors Working For You Are You Keeping Track Of The Payments Made To Them Independent Contractor Work On Yourself Printables

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Financial Planning For Couples Small Business Bookkeeping Bookkeeping Business