Gst Return Form For Small Business

Taxpayers under this scheme will not have input tax credit facility. Order a paper copy.

Gst Return Filing Billing Software For Small Businesses Billing Software Software Small Business

Gst Return Filing Billing Software For Small Businesses Billing Software Software Small Business

Company tax return 2020.

Gst return form for small business. Attend our GST webinar to help you to understand GST and its implications for business. Most small businesses choose to file two-monthly or six-monthly GST returns. Summary of GSTR Return Filing Step 1- Log in to the GST portal Step 2- In the Services menu click on the Returns Dashboard Step 3- Select the Financial Year and the Return Filing Period.

Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. Six-monthly filing is only available if your turnover is less than 500000 although some exceptions apply and it might be good if. Download a PDF of the Company tax return 2020 PDF 576KB This link will download a file.

GST531 Return of Self-Assessment of the First Nations Goods and Services Tax FNGST Election and application forms available to all businesses or individuals GST10 Application or Revocation of the Authorization to File Separate GSTHST Returns and Rebate Application for Branches or Divisions. 11 rows GST returns filing for startups GST return is a document that has to be filed. Refer to Company tax return instructions 2020 for information on how to complete the form.

Composite Taxpayer and GST Filing Composite taxpayers will have to file GSTR 4 which will be filed quarterly. GSTR-4 return form has to be filed by taxpayers who have opted for the Composition Scheme. You only need to register for GST once even if.

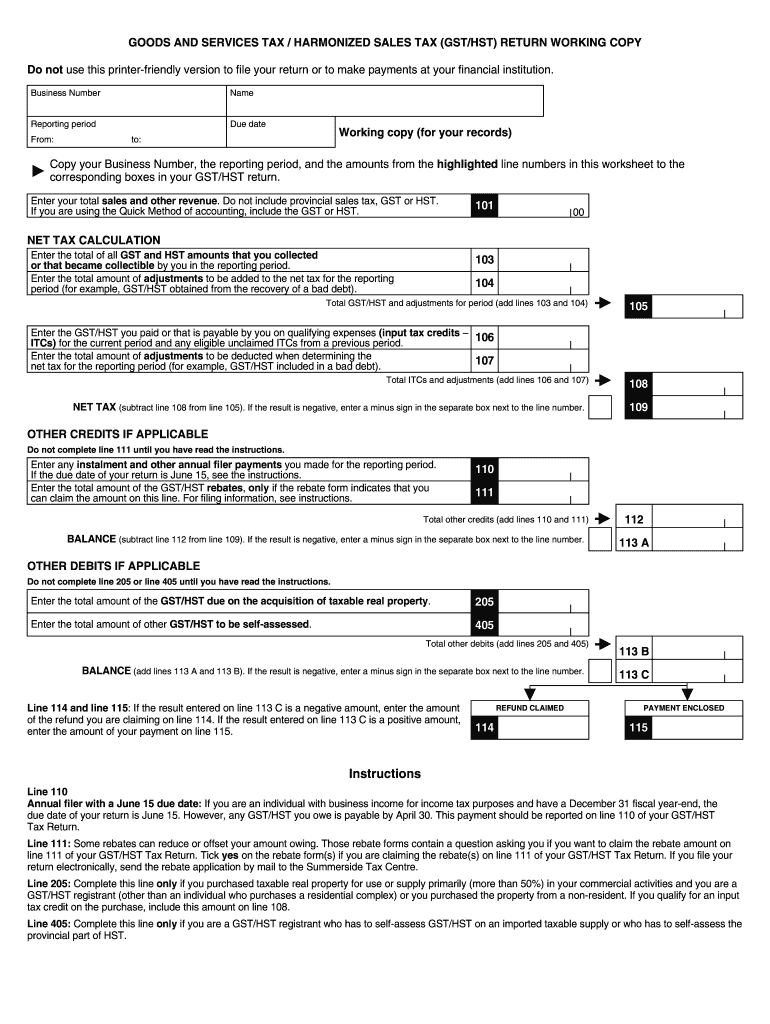

Include the GSTHST you collected or were required to collect on. You are completing a GSTHST return electronically. Goods and Services TaxHarmonized Sales Tax Return for Registrants.

The Company tax return 2020 NAT 0656-62020 is available in Portable Document Format PDF. Taxpayers with small business or a turnover of up to Rs75 lakh can opt for the Composition Scheme wherein he or she have to pay tax at a fixed rate based on the type of business. To get a new access code for GSTHST NETFILE or GSTHST TELEFILE go to GSTHST Access Code Online.

If you didnt file electronically the CRA will mail you. For the election to apply to the sale you have to be able to continue to operate the business with the property acquired under the sale agreement. This line does not appear on an electronic return.

Most Canadian businesses must register to collect and pay the goods and services tax GST and harmonized sales tax HST on eligible itemsIf you are operating a Canadian business and registered for the GSTHST you can get back the GSTHST youve paid out during a particular reporting period by claiming it through input tax credits ITCs on your GSTHST return. If you are a recently self-employed Canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. With the implementation of GST all returns have been so designed that all transactions are in.

Fuel tax credits can only be claimed on your business activity statement BAS. To get a non-personalized version of the paper return Form GST62 use. This is called standard GST registration.

You are completing a paper GSTHST return using the regular method. To request a new GST34-2 or GST34-3 call the Business Enquiries phone line at 1-800-959-5525. Order a paper copy.

Each business will have to file an annual return known as GSTR 9. Registering for GST You can register for goods and services tax GST online by phone or through your registered tax or BAS agent when you first register your business or at any later time. If you electronically filed your last GSTHST return the CRA will mail you an electronic filing information sheet Form GST34-3.

You have to file Form GST44 on or before the day you have to file the GSTHST return for the first reporting period in which you would have otherwise had to pay GSTHST on the purchase. Two-monthly means more paperwork but can be easier to keep track of. If you pay GST by instalments and you are registered for fuel tax credits you cannot claim fuel tax credits on your annual GST return.

Aside from the extra info youll include on your tax return you might also be required to register for a GSTHST account and become a GSTHST Registrant. Form Z is used if you elected to report GST and pay or claim a refund annually and you are registered for fuel tax credits. This will be on top of the monthly returns and is to be filed by 31 st December of the next financial year.

Enter all GSTHST you were required to collect as well as all amounts of GSTHST collected on your supplies of property and services.

A Guide For Updated Gst Return Due Dates With Easy Filing Process Due Date Dating Goods And Service Tax

A Guide For Updated Gst Return Due Dates With Easy Filing Process Due Date Dating Goods And Service Tax

Income Tax Return Form Xls Format Learn All About Income Tax Return Form Xls Format From Thi Statement Template Income Tax Return Tax Return

Income Tax Return Form Xls Format Learn All About Income Tax Return Form Xls Format From Thi Statement Template Income Tax Return Tax Return

Get To Know How To File Gstr 1 Return Form Online Form Easy Guide Online

Get To Know How To File Gstr 1 Return Form Online Form Easy Guide Online

Income Tax Due Date Income Tax Business Intelligence Tools Income Tax Return

Income Tax Due Date Income Tax Business Intelligence Tools Income Tax Return

Free Download Gen Gst Software Fy 2021 22 For E Filing Billing Business Software Software Accounting Software

Free Download Gen Gst Software Fy 2021 22 For E Filing Billing Business Software Software Accounting Software

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Affordable Gst Return Filing Billing Software For Small Businesses Billing Software Tax Software Software

Affordable Gst Return Filing Billing Software For Small Businesses Billing Software Tax Software Software

Check Out The List Of All The Important Due Dates With Respect To Gst And Tds For The Month Of February 2 Indirect Tax Important Dates Goods And Service Tax

Check Out The List Of All The Important Due Dates With Respect To Gst And Tds For The Month Of February 2 Indirect Tax Important Dates Goods And Service Tax

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Bank Statement Paying Taxes

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Bank Statement Paying Taxes

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Accounting Software Income Tax Filing Taxes

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Accounting Software Income Tax Filing Taxes

New Gst Return Forms Anx 1 Anx 2 Pmt 8 Ret 1 Eztax In Small And Medium Enterprises Form Accounting Software

New Gst Return Forms Anx 1 Anx 2 Pmt 8 Ret 1 Eztax In Small And Medium Enterprises Form Accounting Software

Easy Guide To Gst Sugam Return Form With Filing Procedure Sag Infotech Accounting Course Easy Guide Business Names

Easy Guide To Gst Sugam Return Form With Filing Procedure Sag Infotech Accounting Course Easy Guide Business Names

Cooldeal On Twitter Accounting Small And Medium Enterprises Accounting Software

Cooldeal On Twitter Accounting Small And Medium Enterprises Accounting Software

Ca Gst Fill Online Printable Fillable Blank Pdffiller

Ca Gst Fill Online Printable Fillable Blank Pdffiller

Gst Is The Single Indirect Tax That Is Levied On The Supply Of Goods And Services Between Different Entit Indirect Tax Goods And Service Tax Goods And Services

Gst Is The Single Indirect Tax That Is Levied On The Supply Of Goods And Services Between Different Entit Indirect Tax Goods And Service Tax Goods And Services

Gst Return Due Date List Jan 2020 Billing Software Accounting Software Dating

Gst Return Due Date List Jan 2020 Billing Software Accounting Software Dating