Do Nonprofit Corporations Get 1099

A Form 1099 is the miscellaneous income tax form used to prepare and file income information that is separate from wages salaries or tips. A C-corp or S-corp is not with a few exceptions including attorneys physicians and other health care providers.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

However nonprofit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements.

Do nonprofit corporations get 1099. A nonprofit organization has the same responsibility as a business when it comes to issuing 1099 information forms. Non profits are usually set up as corporations. Since nonprofit organizations are corporations a 1099-MISC will not be used.

If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. Personalpayments are not reportable. You are engaged in a trade or business if you operate for gain or profit.

If the nonprofit you paid for sponsorship or provided goods to is a corporation you do not. However since the new 1099-NEC form accounts for the nonemployee compensation there will be some organizations that wont use the 1099-MISC form as much going forward. Medical or Health care payments are reportable but non-employee compensation contractor payments are not reported.

1099-MISC only when payments are made in the course of your trade or business. Operating for gain or profit. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent.

The following payments made to corporations generally must be reported on Form 1099-MISC. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. A Form 1099 must be issued to every non-employee vendor or independent contractor who has provided services to the nonprofit totaling more than 600 during the previous tax year.

Exception to the general rule. Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year. Typically youll receive a 1099 because you earned some form of income from a non-employer source.

From IRSs 1099-Misc instructions. Many nonprofits are corporations. Different accounting and tax rules apply to nonprofit organizations compared to for-profit businesses but a nonprofit still has to issue 1099 forms.

You are engaged in a trade or business if you operate for gain or profit. Ask the vendor to fill out a W-9 form and be sure to check the box for tax filing status. Hello we are a small nonprofit and just read up about the 1099 after remembering I was ask one time when I won a scholarship to fill out a w-9.

1099 Rules indicate that corporations are exempt from receiving 1099 statements EXCEPT for certain items which you must report on a 1099. A non-profit organization including 501 c3 and d organizations. You may begin to receive these documents as.

However corporations are exempt from the 1099 reporting requirements. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. If youre wondering Do LLCs get 1099s the answer depends on the type of business structure.

A sole proprietor or partnership is subject to 1099 reporting. For most non-profits this doesnt create much of a burden. In general sole proprietorships may need to file these but corporations do not.

Unfortunately we did not get the w-9 filled out but I see we must issue a 1099-misc in the reporting tax period next year. However for payments made after December 31 2011 thats all about to change 1. We gave out our first receipient a 1000 scholarship award.

Current IRS Regulations require that information returns be issued to all non-corporate businesses that provide goods or services to the Organization aggregating 600 or more during the year. For payments made after December 31 2011 non-profits will be required to provide a Form 1099-MISC if they make payments aggregating 600 or more to any one payee for. A non-profit is considered to be engaged in a business or trade.

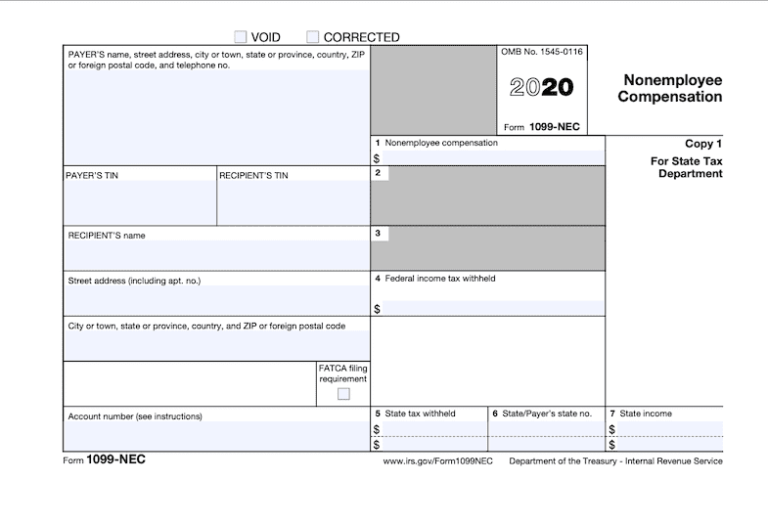

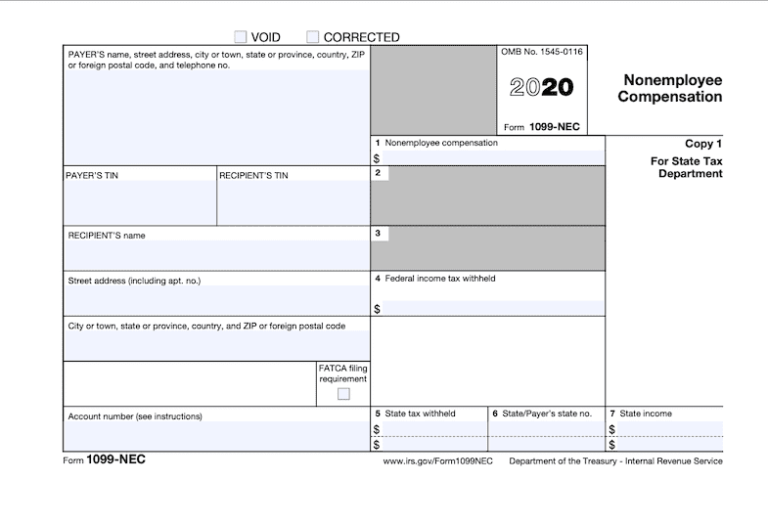

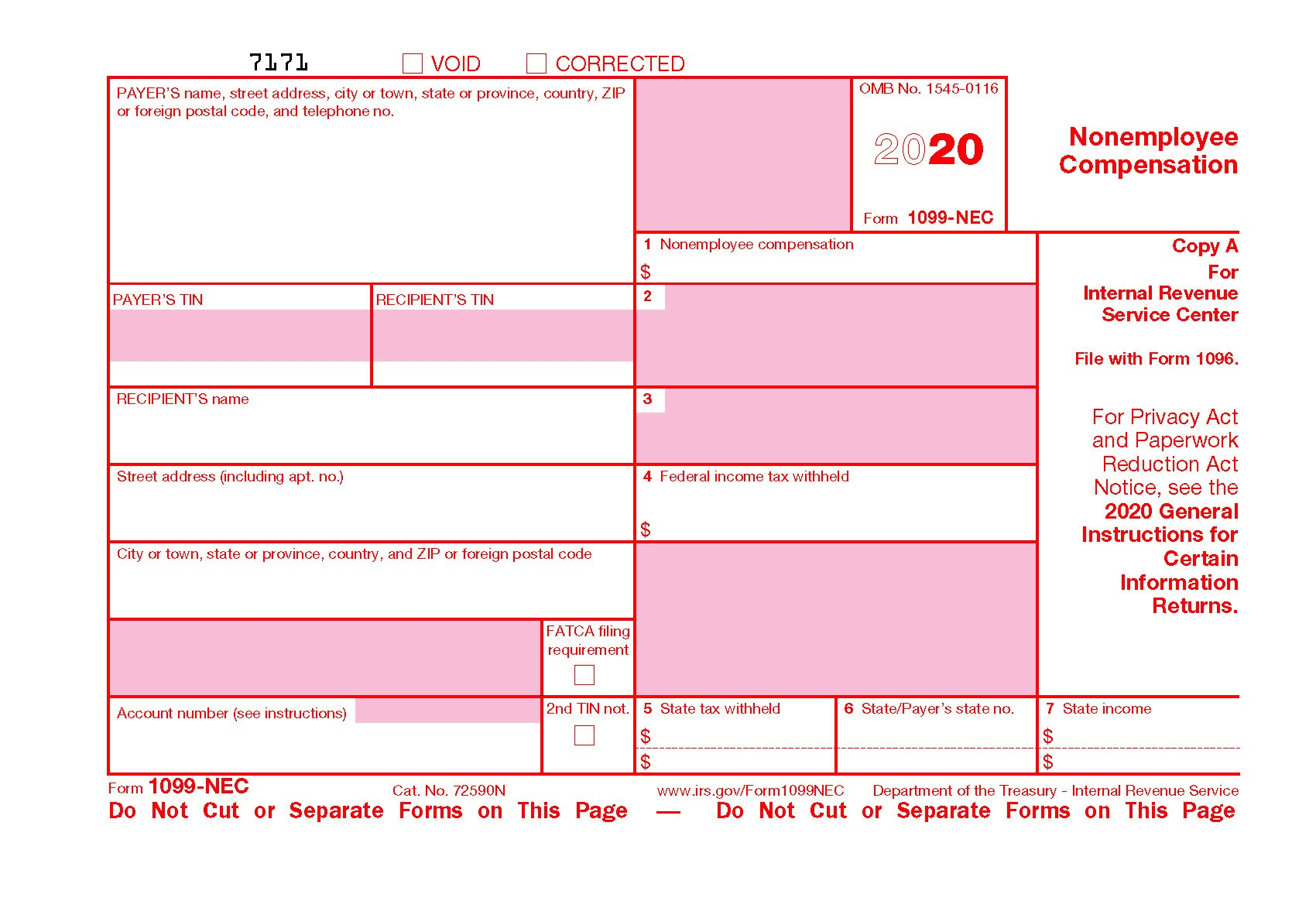

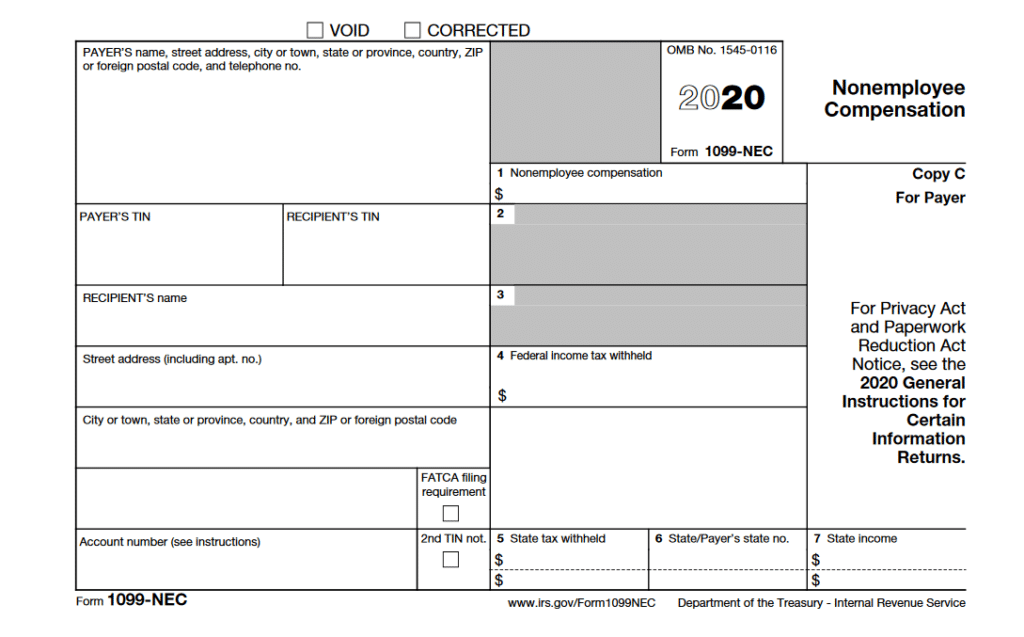

Prior to the 2020 tax year the 1099-MISC was frequently used by nonprofits and churches. Learn more about the changes for the 2020 tax year on the IRS website. For nonprofits you must issue this form when you contract individual workers and vendors to complete work for the organization.

All corporations must receive 1099s. Vendors who operate as C- or S-Corporations do not require a 1099. Report on Form 1099-MISC only when payments are made in the course of your trade or business.

Form 1099-R is issued for payments made to an employee receiving a distribution from the Organizations retirement plan. The IRS considers trade or business to include. Personal payments are not reportable.

However there are exceptions so understanding the laws pertaining to. For most nonprofits the primary concern is Form 1099-MISC which is required.

Which 1099 Forms Should You Complete

Which 1099 Forms Should You Complete

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Who Are Independent Contractors And How Can I Get 1099s For Free

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is A 1099 Misc Form W9manager

What Is A 1099 Misc Form W9manager

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Federal Form 1099 Misc Deadline Irs Forms Irs 1099 Tax Form

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs