How To Get 1099 G Form Online Iowa

Click to Continue your returnTake me to my return. To enter taxable grants from Form 1099-G box 6.

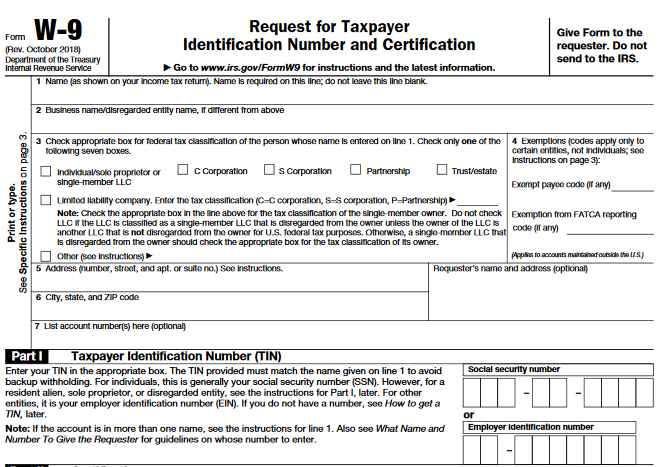

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

The department is now providing Form 1099-G online instead of mailing them.

How to get 1099 g form online iowa. Scroll down to the Federal section. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Log in to your TurboTax Online account or open your TurboTax CDDownload program.

Go to Screen 142 State Tax Refunds Unemployment Comp. Welcome to the Missouri Department of Revenue 1099-G inquiry service. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

I received a 1099 G from the Iowa Dept of Revenue. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. Link is external Iowa Workforce Development will begin mailing form 1099-G on Jan 21 2020.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. 1099Gs are available to view and print online through our Individual Online Services. In January of each year the Iowa Department of Revenue mails to certain taxpayers federal forms 1099-G and 1099-INT.

If you cant download your 1099-G online or you have technical issues with it contact your states Department of Revenue. This will help save taxpayer dollars and allow you to do a small part in saving the environment. Please fill out the following form to request a new 1099 form.

Employer 1099-G Forms to be mailed January 21 2020. Log in to your NYGov ID account. The lookup service option is only available for taxpayers with United States addresses.

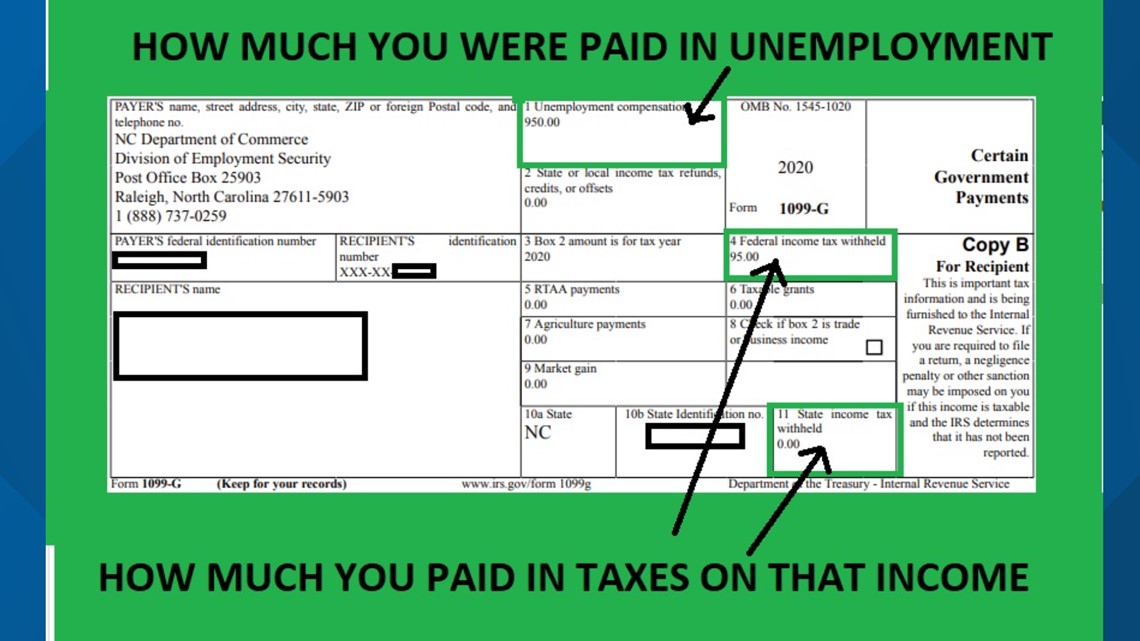

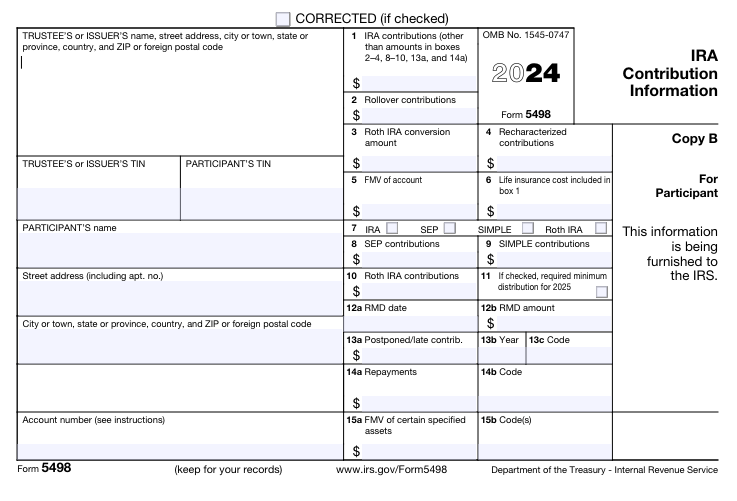

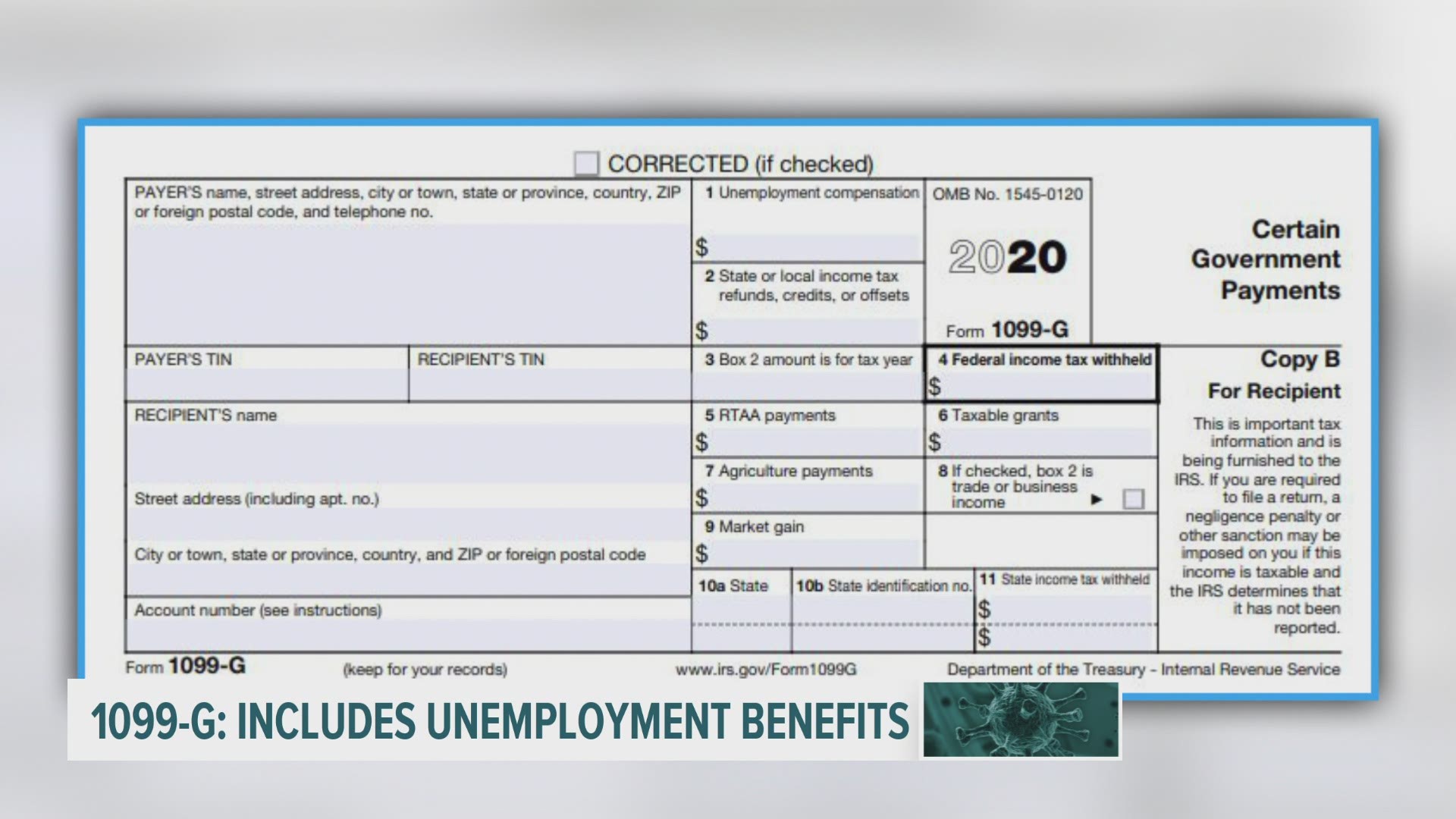

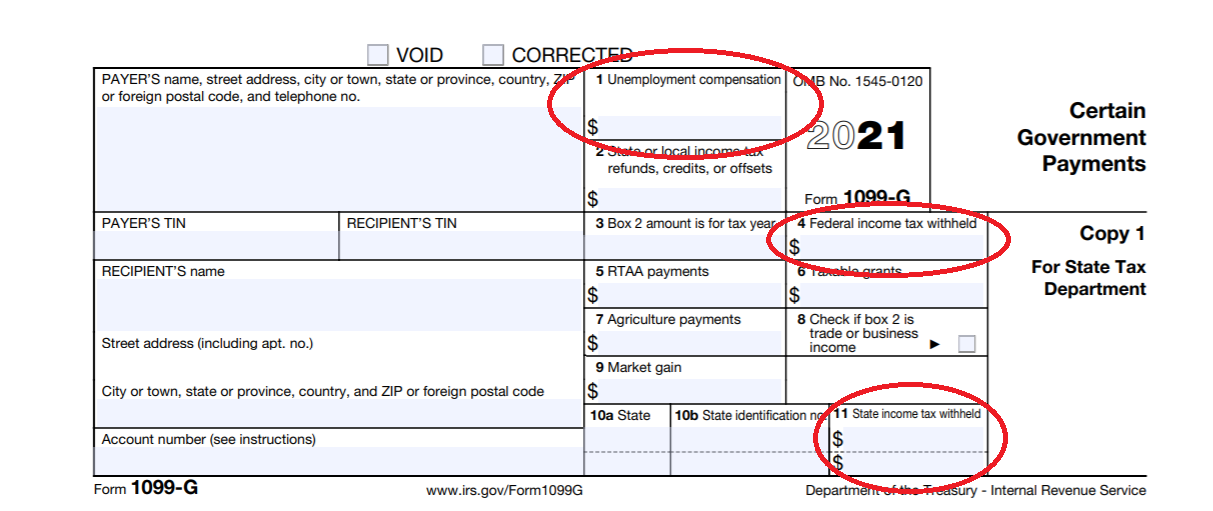

You may choose one of the two methods below to get your 1099-G tax form. How to Get Your 1099-G online. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your federal deductions. You can view or print your forms for the past seven years.

The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. In January of each year the Iowa Department of Revenue mails to certain taxpayers federal forms 1099-G and 1099-INT. Click on Federal Taxes choose the option.

Look for the 1099-G form youll be getting online or in the mail. The Department is required by federal law to send these forms to taxpayers who meet the reporting criteria. You can elect to be removed from the next years mailing by signing up for email notification.

If you live outside of the United States please email us at email protected to mail your form 1099-G. Enter the applicable information as reported on the 1099-G. You may owe Uncle Sam if you didnt withhold taxes.

Select the appropriate year and click View 1099G. The Internal Revenue Service and the State. The Department is now providing 1099-G information online over a secure server that is available anytime.

In addition to providing them to taxpayers the information on the 1099s is furnished to the Internal Revenue Service. The 1099-G includes any unemployment insurance benefits issued December 29 2018 through December 30 2019 and any federal andor state taxes that were withheld. Applicant Services 1099 Information.

The Department is required by federal law to send these forms to taxpayers who meet the reporting criteria. To access this form please follow these instructions. Select Unemployment Services and ViewPrint 1099-G.

Locate the Taxable Grants subsection. A 1099G is issued if you received 10 or more in gross unemployment insurance payments. Form 1099-G reports the amount of refunds credits and other offsets of state income tax during the previous year.

If you cannot access your 1099-G form you may need to reset your password within IDESs secure website. Some states only issue the form by mail so youll have to request it and wait for it to arrive if you never received a copy. You would enter the State or local refund information reported on the 1099-G in TurboTax by doing the following.

If your responses are verified you will be able to view your 1099-G form. In addition to providing them to taxpayers the information on the 1099s is furnished to the Internal Revenue Service. You must complete all fields to have your request processed.

Ill choose what I work on if offered. These forms are available online from the NC DES or in the mail. Click on Add or click on the appropriate Payer from the left navigation panel.

If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. You should be able to get an electronic copy if you log into CONNECT and go to My 1099-G and 49Ts in the main menu. Visit the Department of Labors website.

There are three options. The Department of Revenues 1099-G only applies to individuals who itemize their deductions on their. If its convenient consider stopping by the state unemployment office.

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

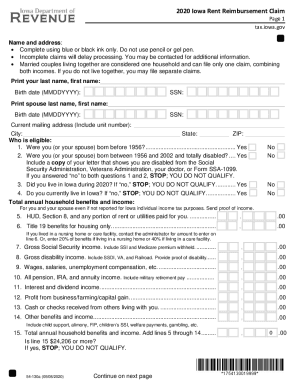

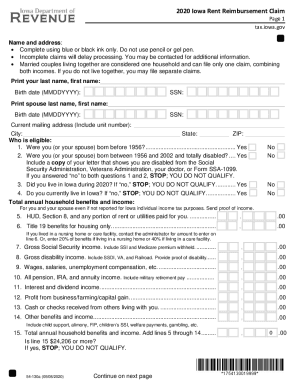

Fillable Online Rent Reimbursement Claim 54 130 Fax Email Print Pdffiller

Fillable Online Rent Reimbursement Claim 54 130 Fax Email Print Pdffiller

3 8 45 Manual Deposit Process Internal Revenue Service

3 8 45 Manual Deposit Process Internal Revenue Service

File 5498 Form Online Print Mail E File As Low As 0 50 Form

File 5498 Form Online Print Mail E File As Low As 0 50 Form

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

A Zwater For Elephants A 20101 Amazing Facts Sponsored Amazing Facts Download Water Ad Water For Elephants Facts Fun Facts

A Zwater For Elephants A 20101 Amazing Facts Sponsored Amazing Facts Download Water Ad Water For Elephants Facts Fun Facts

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Where Can I Physically Pick Up 1099 And W 2 Forms Quora

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Printable Job Applications Rental Agreement Templates

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Printable Job Applications Rental Agreement Templates

1215 The Year Of Magna Carta Paperback Magna Carta Gillingham Trial By Ordeal

1215 The Year Of Magna Carta Paperback Magna Carta Gillingham Trial By Ordeal