How To Claim Back Business Mileage

Youll report your miles and also answer a few questions about the vehicle on Form 2106. A log of the date of each journey and location The number of business miles.

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Mileage rates are 45p per mile for the first 10000 miles and then 25p per mile.

How to claim back business mileage. If your claim is for the current tax year HM Revenue and Customs HMRC will usually make any adjustments needed. Standard mileage deduction. You have two options for deducting your vehicle expenses.

To use the standard deduction you must use it in the first year then you can choose either method in later years. You could claim 8400 for the year using the standard mileage rate method. If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR.

Subtract the received MAP from the approved amount you should have received. Add up all your motor expenses for the year. Add up your business mileage for the whole year.

You can claim mileage on your tax return if you kept diligent track of your drives throughout the year. Alternately they can claim their actual vehicle. Digitally Claim Back Business Mileage A digital mileage claim system works in the same way as manually claiming back business mileage except information is collected automatically and accurately via a GPS tracking device.

Multiply 15000 by the mileage deduction rate of 56 cents 15000 X 056. You calculate your car van or motorcycle expenses using a flat rate for mileage. In this short blog were going to find out how to claim business mileage as an expense.

Did you know that you can claim the tax back for work travel. Using your own vehicle for work. If youre one of the types of employees listed above youll also be able to claim mileage on your individual tax return at the rate of 0575 in 2020.

You must claim within 4 years of the end of the tax year that you spent the money. In 2019 you can write off 58 cents for every business mile. Consequently a paperless solution protects.

If your claim exceeds 2500 you must file a self-assessment tax return. You will usually receive 20 - 40 of the final amount back as a rebate depending on the rate of tax you pay. Lets say you drove 15000 miles for business in 2021.

Deduct your employers mileage limit if applicable. There are some restrictions on the use of these two methods. For amounts less than 2500 file your claim.

Theres no need to submit any of your records. However you should keep all of your records just in case you ever need to prove any details you included in your tax return. Add up the Mileage Allowance Payments you have received throughout the year.

This will give you the amount on which you can claim tax relief amount not the rebate. Employees must follow the same rules that business owners and other self-employed workers follow. Add up the mileage for each vehicle type youve used for work.

Mileage Allowance Relief can be calculated by multiplying your business mileage by the Approved Rates set out below. To claim back your self-employed mileage allowance you simply need to include the amount in the expenses section of your self-assessment tax return. Sole traders claiming mileage reduce their profits and thus pay less tax.

If you are using your own vehicle for work and are being reimbursed less than 045p per mile by your employer you could be claiming business mileage tax back. This way is normally simpler although youll need to keep a detailed mileage log. Self-employed workers can claim their mileage deduction on their Schedule C tax form rather than a Schedule A form for itemized deductions.

To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction rate. On your self-assessment tax return. The standard mileage rate or the actual expense method.

There are two approaches you can take. Take away any amount your employer pays you towards your costs sometimes called a mileage allowance. Claiming Back Your Mileage Tax It Takes 2 Minutes.

To ensure that you can claim back mileage as a sole trader director or for your employees the following records should be kept. Alternatively if you do not file a self-assessment tax return use form P87. Keep records of the dates and mileage or your work journeys.

The employer can claim this cost as expenses against corporation tax. For the standard mileage rate multiply the total business miles by the standard mileage for the year. Calculate the number of business miles as a percentage of your total miles.

If you are self-employed use your business mileage claims to get tax relief. If the employer does not pay business mileage or pay less than HMRC expects them to see below an employee can claim the difference at the end of the tax year.

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Business Checklist

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

How To Record Mileage Help Center

How To Record Mileage Help Center

Awesome Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your A Real Estate Checklist Real Estate Tips Real Estate Marketing

Awesome Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your A Real Estate Checklist Real Estate Tips Real Estate Marketing

Mileage Logbook Mileage Log Record Book Notebook For Business Or Personal Tracking Your Daily Miles By Automotive Press Books Independently Published Recorded Books Automotive Engineering Mileage

Mileage Logbook Mileage Log Record Book Notebook For Business Or Personal Tracking Your Daily Miles By Automotive Press Books Independently Published Recorded Books Automotive Engineering Mileage

Reimbursement Request Form Template Awesome Mileage Reimbursement Form 9 Free Sample Example Time Sheet Printable Formal Business Letter Format Mileage

Reimbursement Request Form Template Awesome Mileage Reimbursement Form 9 Free Sample Example Time Sheet Printable Formal Business Letter Format Mileage

Business Mileage The Holy Grail Of Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions

Mileage Claim Form Malaysia Five Moments That Basically Sum Up Your Mileage Claim Form Malay Word Template Letter Template Word Words

Mileage Claim Form Malaysia Five Moments That Basically Sum Up Your Mileage Claim Form Malay Word Template Letter Template Word Words

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

How To Make The Most Of Business Mileage Deductions Due

How To Make The Most Of Business Mileage Deductions Due

Medical Mileage Expense Form Mileage Expensive Medical

Medical Mileage Expense Form Mileage Expensive Medical

Mileage Claim Form 10 Stereotypes About Mileage Claim Form That Aren T Always True Teaching Schools Student Resume Template Student Resume

Mileage Claim Form 10 Stereotypes About Mileage Claim Form That Aren T Always True Teaching Schools Student Resume Template Student Resume

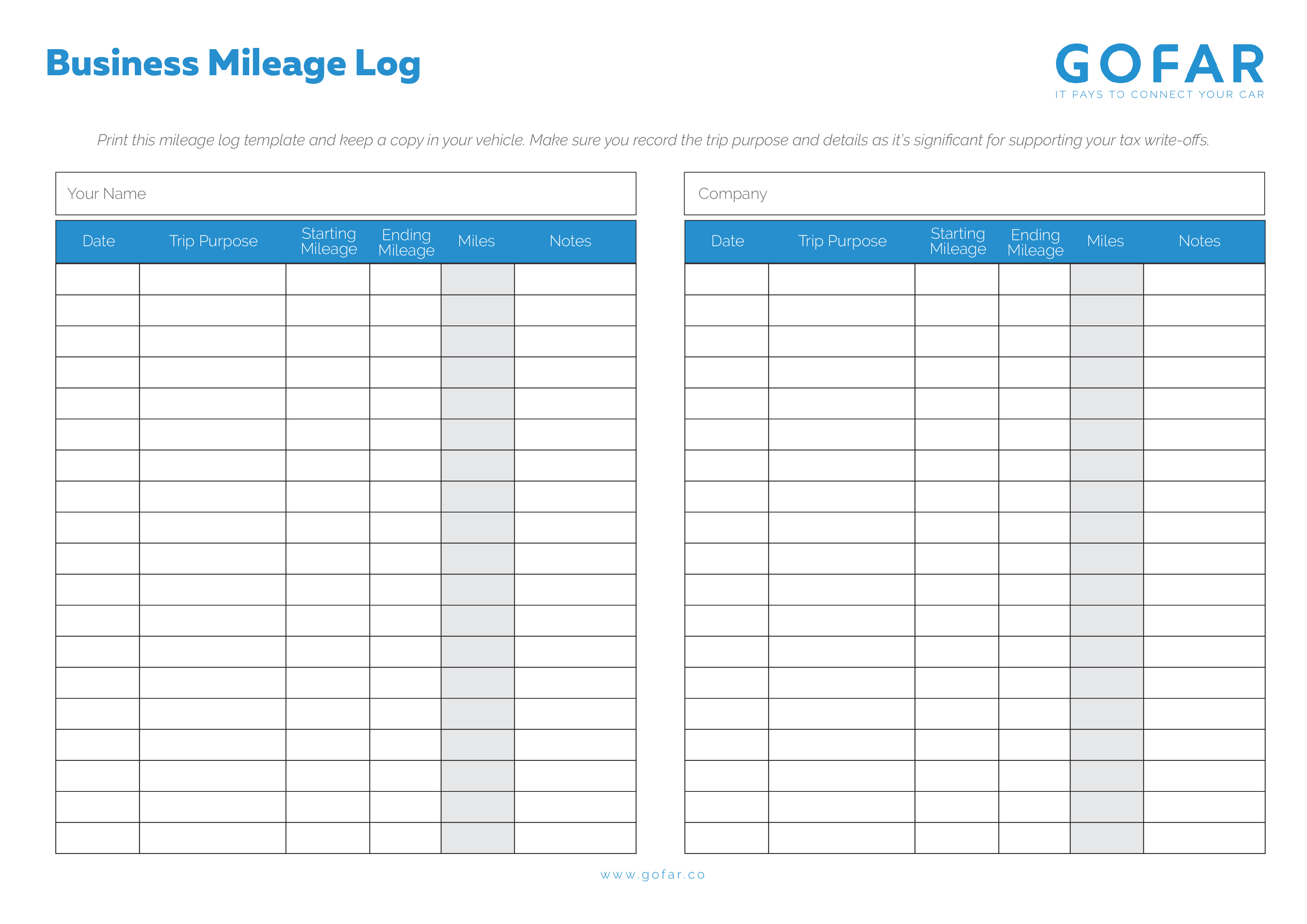

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Simple Expense Reimbursement Form Form Resume Examples Throughout Reimbursement Form Template Word Best Templates Business Template Spreadsheet Template

Simple Expense Reimbursement Form Form Resume Examples Throughout Reimbursement Form Template Word Best Templates Business Template Spreadsheet Template

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Expenses Stock Photo Which Shows A Standard Uk Expense Form Not Yet Filled Out Tax Debt Tax Debt Relief Business Mileage

Expenses Stock Photo Which Shows A Standard Uk Expense Form Not Yet Filled Out Tax Debt Tax Debt Relief Business Mileage

25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar