Form Of Business Entity Concept

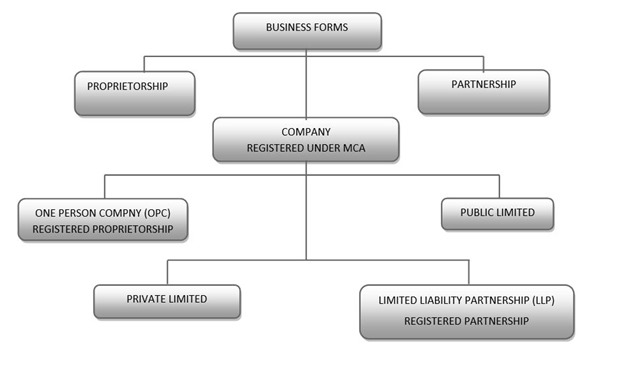

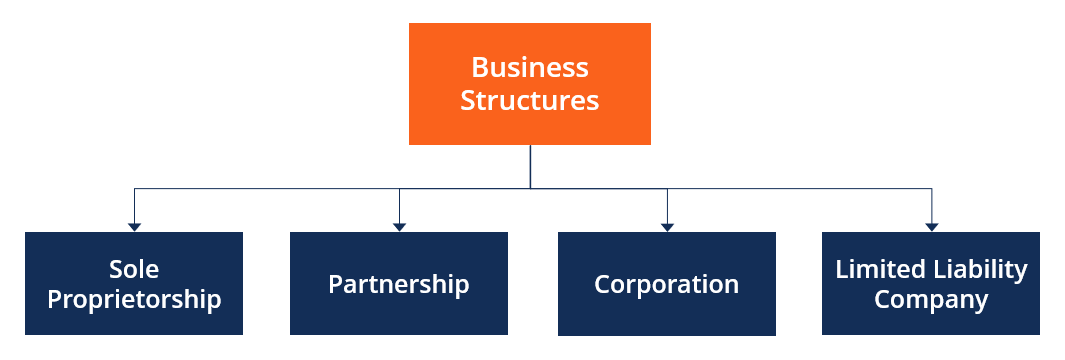

This concept is also called Economic Entity Principle which explains that all the businesses related businesses and the owners are separate entities and therefore these must be dealt with and. Types of business entities includecorporationspartnershipslimited liability companieslimited liability partnerships and sole proprietorships.

Each business entity is taxed separately.

Form of business entity concept. The events that affect anyone else other than the business. Definition of Business Entity Concept. The main objective of the business entity principle is to report the financial matters of a business from the perspective of the business itself.

The business entity concept declares that a business stands independently from its owner and hence the two should be treated as separate entities when recording transactions. The business entity definition is an organization founded by one or more natural persons to facilitate specific business activities or to allow its owners to engage in a trade. Business Entity Concept Definition.

The business entity concept states that a business is an entity in itself and it should be treated as a separate person which is different from its owner. It is needed to calculate the financial performance and financial position of an entity. The business entity principle requires each business to be treated separately from its owners for accounting purposes.

In other words while recording transactions in a business we take into account only those events that affect that particular business. Business entity concept is also known as a separate entity concept and economic entity concept. The business entity is therefore considered to be distinct from its owners for the purpose of accounting.

According to the business entity principle though a single person runs the business they should be considered as. There are generally no restrictions on the number or type of owners of an LLC. An accounting entity is a business for which a separate set of accounting records is maintained.

One person runs it and the profits are all for himself. A limited liability company LLC is a unique form of business entity. It is run by an individual for his.

Business Entity Concept Definition. This is the simplest and basic form of a business entity. LLC owners are called members.

Therefore all business transactions income expenses assets liabilities and equity must be kept separate from the owners personal account to ensure accurate accounting records. Reasons for the Business Entity Concept. Under this principle the agency will report all transactions separately from the owner thereof.

There are a number of reasons for the business entity concept including. The people who run an LLC are called managers. For example an entitys owner withholds the entitys cash for the use of the personnel concerns.

It is the first and most basic type of business entity. The business entity concept also known as separate entity and economic entity concept states that the transactions related to a business must be recorded separately from those of its owners and any other business. However the organizational documents can change this terminology.

Personal activities of the owners are kept separate from the business transactions and excluded from the financial statements. A partnership can be of two types general partnership and a limited liability partnership. Under the Business entity concept it is assumed that for the purpose of accounting practice business and.

The stock shareholders are considered the legal owners of the company. Types of Business Entities Sole traderProprietorship. Limited Liability Company.

Overview of Business Entity Concept. Business Entity Concept states that the business and the owner are two separate entities and accordingly must be treated separately. Financial accounting is based on the premise that the transactions and balances of a business entity are to be accounted for separately from its owners.

1 Sole Trader or Proprietorship. The idea of the business enterprise assumes that the owner of an organization has specific legal responsibilities for the company. There are many types of business entities such as sole proprietorships partnerships corporations and government entities.