Do Software Companies Get A 1099

If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

For contractors that operate and file taxes as corporations such as a C-corp.

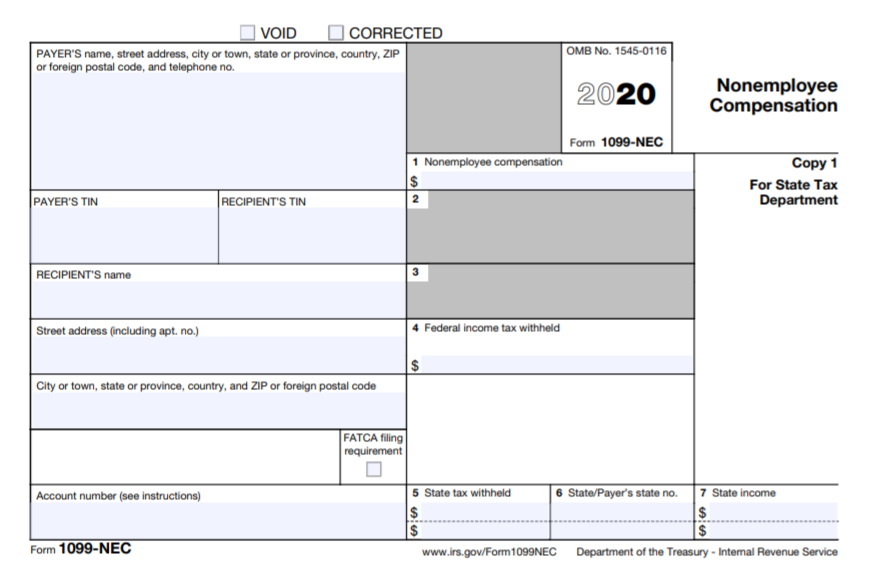

Do software companies get a 1099. Is any foreign entity eg foreign individual foreign company etc. To learn more about setting up 1099 please refer to this article. Instructions to Form 1099-NEC.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. Thus personal payments arent reportable. If you do not want to import your data you can type inside W2 Mate and then print.

The Substitute Form W-9 is available on the. If you paid anyone more than 600 who isnt an employee you probably have to send out this form. You should obtain a completed Substitute Form W-9 when initiating any transaction with a new vendor that could be reportable on a 1099-MISC.

Contractors may sometimes check the incorrect box on their W-9 or fail to file in time. This payment would have been for services performed by a person or company who IS NOT the payors employee. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks.

A 1099-MISC is the form any business sends anyone they pay to do a service who isnt an employee. What if You File a 1099 for an LLC that Doesnt Require One. Whenever the Forms 1099 arrive dont ignore them.

1099 Rules Regulations Who must file. Older versions of QuickBooks 2017 2016 2015 and before will not support 1099-NEC filing. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

The exception to this rule is with paying attorneys. You get the best 1099 software for your small business. The vendors or contractors will only receive the 1099-MISC once they reach the threshold amount in a calendar year.

Instead a 1099 vendor will send you a 1099 invoice after performing work for. Get help from a tax professional or use tax preparation software to prepare this form. Internal Revenue Service IRS requires businesses to issue a Miscellaneous Income Form 1099-MISC return to the people and companiesincluding limited liability companies LLCsthey pay if the arrangement between the business and the service provider meets certain requirements Instructions for 1099-MISC.

Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year. They are not an employee so they do not receive hourly or salary wages for each payroll period. You will need to provide a 1099 to any vendor who is a.

If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll. The IRS regulations for Form 1099-MISC are complex and every business situation is unique. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT.

Vendors who operate as C- or S-Corporations do not require a 1099. The company is providing the operator and the equipment and the rental company will be responsible to issue a 1099. You do not need to issue a 1099-NEC for the operator.

Regardless of industry business objective or technology CheckMark 1099 software gives you all the features youd expect from powerful 1099 software. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. A 1099 form is a tax document filed by an organization or individual that paid you during the tax year.

This is the equivalent of a W-2 for a person thats not an employee. A person is engaged in business if he or she operates for profit. Weve worked really hard to build the powerful 1099 software for small businesses having anything from standard to complex 1099 requirements.

For tax purposes theyre treated as corporations so in general they dont get a 1099. However a few exceptions exist that require a. Hence youre required to give your carries a 1099-MISC if you paid them more than 600 in a calendar year.

The information in this article is intended to be a general overview and not to be used as detailed instructions for completing this form. In this case you can use our W2 Mate software to import 1099 amounts from QuickBooks and then prepare your 1099-NEC forms. Payments to Report A Form 1099 MISC must be filed for each person to whom payment is made of.

Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC.

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

How To Do Your Own Taxes And Prepare For Filing A Complete Guide Careful Cents Small Business Tax Business Tax Tax

How To Do Your Own Taxes And Prepare For Filing A Complete Guide Careful Cents Small Business Tax Business Tax Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

13 Form Sample 13 Disadvantages Of 13 Form Sample And How You Can Workaround It Quarterly Taxes Tax Software Small Business Accounting

13 Form Sample 13 Disadvantages Of 13 Form Sample And How You Can Workaround It Quarterly Taxes Tax Software Small Business Accounting

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager