Are Doordash Employees 1099

My Account Tools Topic Search Type 1099misc Go Enter your 1099misc and follow the prompts. You may receive a 1099-NEC depending on.

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

Incentive payments and driver referral payments.

Are doordash employees 1099. The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. Form 1099-NEC is new. If you have 10991040 schedule C income you likely qualify for PPP funding NEW RULES as of March 3 2021 can mean BIG MONEY for Schedule C borrowers.

On your 1099-MISC this is what it will look like. These items can be reported on Schedule C. The 1099-NEC short for Non-Employee Compensation is used to report direct payment of 600 or more from a company for your services.

W-2 forms are sent to employees. Get breakfast lunch dinner and more delivered from your favorite restaurants right to your doorstep with one easy click. Non-employee compensation includes relevant information for your taxes.

I am working for Doordash - I was told they would give me a 1099 at the end of the year - will that hurt me tax wise when I file for 2017. It will look like this. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

Form 1099-NEC reports income you received directly from DoorDash ex. Typically you will receive your 1099 form before January 31 2017. It will look like this.

Where are my earnings reported on the form. I started DoorDash last year in November and made 800. Why am I receiving a 1099-NEC and not a 1099-MISC.

Turns out they want you to pay since youre considered self-employed they. Last year this information was reported on Form 1099-MISC box 7. From a practical standpoint when it comes to filling out the Payable form for your 1099 as a Doordash or Instacart contractor it really doesnt matter if you choose Individual or Sole Proprietor.

Typically you will receive your 1099 form before January 31 2021. Doordash will send you a 1099-NEC form to report income you made working with the company. In the past they would send a 1099-MISC form but the 1099-NEC is replacing that form as of the year 2020.

Youll only get a 1099-MISC form after earning more than 600 with a company. Gig workers contractors UberDoordashPostmates drivers VrboAirbnb owners freelancers Upworkers and more. HttpsupsideapplinkY9PDJG apply for trusted gig jobs without the hassle.

Its free to apply and your loan can be 100 forgiven. As an independent contractor you agreed to deliver for Doordash as a business and not an employee. Get cashback for gas.

Doordash will send you a 1099-MISC form to report income you made working with the company. Toggle navigation DoorDash Dasher. Void in Puerto Rico and where prohibited or restricted by law.

The 1099 form is meant for the self-employed but it also can be used to report government payments interest dividends and more. The DoorDash 1099 Sweepstakes the Giveaway is open to Dashers who are 1099 eligible as of 2020 are eighteen 18 years of age or older at the time of entry and are legal residents of the United States. If you earn more than 600 in payments during the last year from the DoorDash app then you will receive a Form 1099-NEC Nonemployee Compensation from Payable.

And its not a disaster if you checked Single member LLC. Can I change my election for delivery preference. The most important box on this form that youll need to use is Box 7 Nonemployee Compensation.

No only Dashers who earned 600 or more within a calendar year will receive a 1099-NEC form. The DoorDash income Form 1099misc is considered self employment income. Logout Login Login.

Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Doordash couriers are independent contractors and not employees. What it means is that you are a self-employed independent contractor with your own business.

If youve received a form from Doordash that means according to their records youve earned over 600 from them. Up to 10 cash back Best local restaurants now deliver. I want to file my taxes this year to prove income and had a very hard time figuring out what to do until I heard about TaxAct and TurboTax.

The income as well as expenses including your vehicle can be entered by following the information below.

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Paying Your Taxes As A Dasher 1099 Form Doordash Youtube

Paying Your Taxes As A Dasher 1099 Form Doordash Youtube

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

Everything You Need To Know About Doordash Taxes 1099 Taxes From An Accountant Youtube

Everything You Need To Know About Doordash Taxes 1099 Taxes From An Accountant Youtube

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

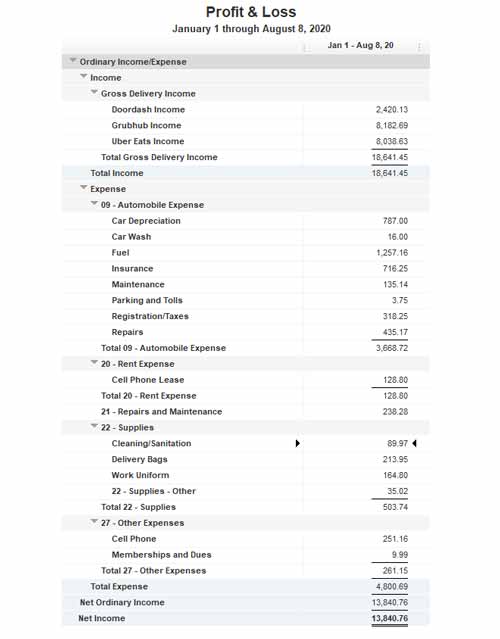

How Do I Verify My Income For Doordash Uber Eats Grubhub Lyft

How Do I Verify My Income For Doordash Uber Eats Grubhub Lyft

How To Do Taxes For Doordash Drivers 2020 Youtube

How To Do Taxes For Doordash Drivers 2020 Youtube

Doordash 1099 Page 1 Line 17qq Com

Doordash 1099 Page 1 Line 17qq Com

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Doordash 1099 Page 1 Line 17qq Com

Doordash 1099 Page 1 Line 17qq Com

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Doordash Filing 1099 Taxes The Process Youtube

Doordash Filing 1099 Taxes The Process Youtube

How Much Did I Earn On Doordash Entrecourier

How Much Did I Earn On Doordash Entrecourier

How Much Did I Earn On Doordash Entrecourier

How Much Did I Earn On Doordash Entrecourier

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Self Employment Tax Grubhub Doordash Instacart Uber Eats